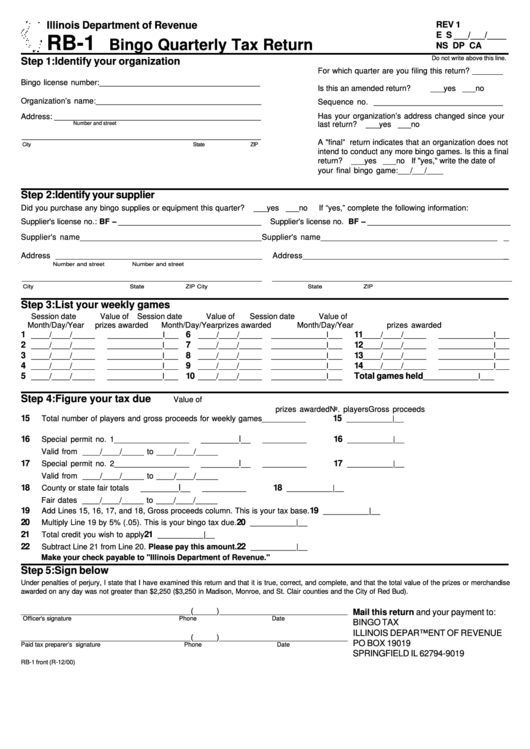

Illinois Department of Revenue

REV 1

E S ___/___/____

RB-1

Bingo Quarterly Tax Return

NS DP CA

Do not write above this line.

Step 1: Identify your organization

For which quarter are you filing this return? _______

Bingo license number:___________________________________

Is this an amended return?

___yes ___no

Organization’s name:____________________________________

Sequence no. _____________________________

Has your organization’s address changed since your

Address: _____________________________________________

Number and street

last return?

___yes ___no

____________________________________________________

A "final” return indicates that an organization does not

City

State

ZIP

intend to conduct any more bingo games. Is this a final

return?

___yes ___no If "yes," write the date of

your final bingo game:___/___/____

Step 2: Identify your supplier

Did you purchase any bingo supplies or equipment this quarter?

___yes ___no

If “yes,” complete the following information:

Supplier's license no.: BF – _________________________________

Supplier's license no. BF – _________________________________

Supplier's name________________________________________

Supplier's name________________________________________

Address _____________________________________________

Address______________________________________________

Number and street

Number and street

_________________________________________________________________________

_________________________________________________________________________

City

State

ZIP

City

State

ZIP

Step 3: List your weekly games

Session date

Value of

Session date

Value of

Session date

Value of

Month/Day/Year

prizes awarded

Month/Day/Year

prizes awarded

Month/Day/Year

prizes awarded

1

6

11

____/____/_____

____________l___

____/____/_____

____________l___

____/____/_____

____________l___

2

7

12

____/____/_____

____________l___

____/____/_____

____________l___

____/____/_____

____________l___

3

8

13

____/____/_____

____________l___

____/____/_____

____________l___

____/____/_____

____________l___

4

9

14

____/____/_____

____________l___

____/____/_____

____________l___

____/____/_____

____________l___

5

10

Total games held

____/____/_____

____________l___

____/____/_____

____________l___

____________l___

Step 4: Figure your tax due

Value of

prizes awarded

No. players

Gross proceeds

15

15

Total number of players and gross proceeds for weekly games

__________

__________|__

16

________l__

16

Special permit no. 1_________________

__________

__________|__

Valid from ____/____/_____ to ____/____/_____

17

________l__

17

Special permit no. 2_________________

__________

__________|__

Valid from ____/____/_____ to ____/____/_____

18

________l__

18

County or state fair totals

__________

__________|__

Fair dates ____/____/_____ to ____/____/_____

19

19

Add Lines 15, 16, 17, and 18, Gross proceeds column. This is your tax base.

__________|__

20

20

Multiply Line 19 by 5% (.05). This is your bingo tax due.

__________|__

21

21

Total credit you wish to apply

__________|__

22

22

Subtract Line 21 from Line 20. Please pay this amount.

__________|__

Make your check payable to "Illinois Department of Revenue."

Step 5: Sign below

Under penalties of perjury, I state that I have examined this return and that it is true, correct, and complete, and that the total value of the prizes or merchandise

awarded on any day was not greater than $2,250 ($3,250 in Madison, Monroe, and St. Clair counties and the City of Red Bud).

_____________________________________(_____)____________________________

Mail this return and your payment to:

Officer's signature

Phone

Date

BINGO TAX

ILLINOIS DEPARTMENT OF REVENUE

_____________________________________(_____)____________________________

PO BOX 19019

Paid tax preparer’s signature

Phone

Date

SPRINGFIELD IL 62794-9019

RB-1 front (R-12/00)

1

1 2

2