Rb-1 - Bingo Quarterly Tax Return

Download a blank fillable Rb-1 - Bingo Quarterly Tax Return in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Rb-1 - Bingo Quarterly Tax Return with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

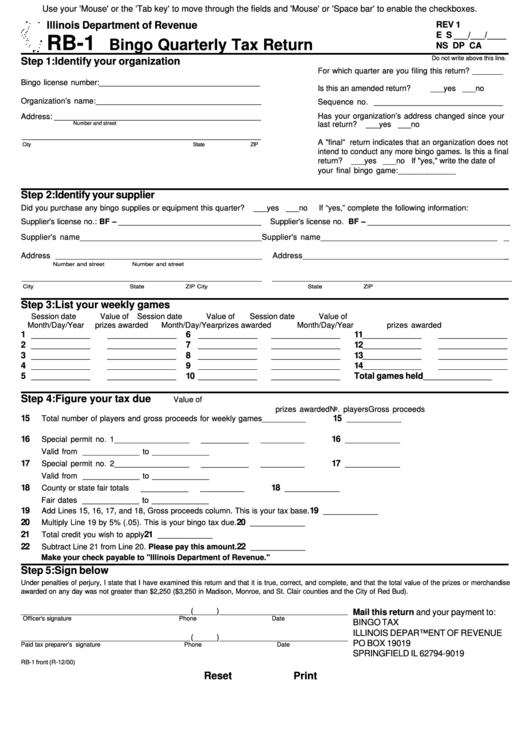

Use your 'Mouse' or the 'Tab key' to move through the fields and 'Mouse' or 'Space bar' to enable the checkboxes.

Illinois Department of Revenue

REV 1

E S ___/___/____

RB-1

Bingo Quarterly Tax Return

NS DP CA

Do not write above this line.

Step 1: Identify your organization

For which quarter are you filing this return? _______

Bingo license number:___________________________________

Is this an amended return?

___yes ___no

Organization’s name:____________________________________

Sequence no. _____________________________

Has your organization’s address changed since your

Address: _____________________________________________

Number and street

last return?

___yes ___no

____________________________________________________

A "final” return indicates that an organization does not

City

State

ZIP

intend to conduct any more bingo games. Is this a final

return?

___yes ___no If "yes," write the date of

your final bingo game:______________

Step 2: Identify your supplier

Did you purchase any bingo supplies or equipment this quarter?

___yes ___no

If “yes,” complete the following information:

Supplier's license no.: BF – _________________________________

Supplier's license no. BF – _________________________________

Supplier's name________________________________________

Supplier's name________________________________________

Address _____________________________________________

Address______________________________________________

Number and street

Number and street

_________________________________________________________________________

_________________________________________________________________________

City

State

ZIP

City

State

ZIP

Step 3: List your weekly games

Session date

Value of

Session date

Value of

Session date

Value of

Month/Day/Year

prizes awarded

Month/Day/Year

prizes awarded

Month/Day/Year

prizes awarded

1

6

11

_____________

_______________

_____________

_______________

_____________

_______________

2

7

12

_____________

_______________

_____________

_______________

_____________

_______________

3

8

13

_____________

_______________

_____________

_______________

_____________

_______________

4

9

14

_____________

_______________

_____________

_______________

_____________

_______________

5

10

Total games held

_____________

_______________

_____________

_______________

_______________

Step 4: Figure your tax due

Value of

prizes awarded

No. players

Gross proceeds

15

15

Total number of players and gross proceeds for weekly games

__________

____________

16

__________

16

Special permit no. 1_________________

__________

____________

Valid from _____________ to _____________

17

__________

17

Special permit no. 2_________________

__________

____________

Valid from _____________ to _____________

18

__________

18

County or state fair totals

__________

____________

Fair dates _____________ to _____________

19

19

Add Lines 15, 16, 17, and 18, Gross proceeds column. This is your tax base.

____________

20

20

Multiply Line 19 by 5% (.05). This is your bingo tax due.

____________

21

21

Total credit you wish to apply

____________

22

22

Subtract Line 21 from Line 20. Please pay this amount.

____________

Make your check payable to "Illinois Department of Revenue."

Step 5: Sign below

Under penalties of perjury, I state that I have examined this return and that it is true, correct, and complete, and that the total value of the prizes or merchandise

awarded on any day was not greater than $2,250 ($3,250 in Madison, Monroe, and St. Clair counties and the City of Red Bud).

_____________________________________(_____)____________________________

Mail this return and your payment to:

Officer's signature

Phone

Date

BINGO TAX

ILLINOIS DEPARTMENT OF REVENUE

_____________________________________(_____)____________________________

PO BOX 19019

Paid tax preparer’s signature

Phone

Date

SPRINGFIELD IL 62794-9019

RB-1 front (R-12/00)

Reset

Print

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1