2013 MI-1045, Page 2

Filer’s Social Security No.

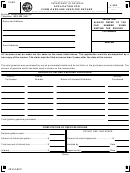

Application for Refund From Carryback of Net Operating Loss

A

B

C

PART 2: REDETERMINING YOUR MICHIGAN INCOME TAX

23. Year you are carrying the NOL to ..................................................

24. Reported federal AGI ....................................................................

00

00

00

25. Additions from MI-1040, Schedule 1 and DPAD. Explain: ______

___________________________________________________

00

00

00

26. Balance. Add lines 24 and 25 ........................................................

00

00

00

27. Subtractions from MI-1040, Schedule 1. Explain: ____________

___________________________________________________

00

00

00

28. Balance. Subtract line 27 from line 26 ...........................................

00

00

00

29. Enter Net Operating Loss from line 22 ..........................................

00

00

00

30. Balance. Subtract line 29 from line 28 ...........................................

00

00

00

31. Michigan exemption allowance......................................................

00

00

00

32. Taxable balance. Subtract line 31 from line 30 .............................

00

00

00

33. Tax. Multiply line 32 by applicable tax rate.

If less than zero, enter “0”..............................................................

00

00

00

34. Nonrefundable tax credits..............................................................

00

00

00

35. Tax due. Subtract line 34 from line 33.

If less than zero, enter “0”..............................................................

00

00

00

36. a. Refundable tax credits ...............................................................

00

00

00

b. Tax withheld ...............................................................................

00

00

00

c. Tax paid with prior returns ..........................................................

00

00

00

d. Estimated tax payments ............................................................

00

00

00

37. Total of items 36a through 36d ......................................................

00

00

00

38. Tax previously refunded or carried to next year.............................

00

00

00

39. Balance of tax paid. Subtract line 38 from line 37 .........................

00

00

00

40. Overpayment. Subtract line 35 from line 39 ..................................

00

00

00

Preparer Certification.

Taxpayer Certification.

I declare under penalty of perjury that this

I declare under penalty of perjury that the information in this

return is based on all information of which I have any knowledge.

return and attachments is true and complete to the best of my knowledge.

Filer’s Signature

Date

Preparer’s PTIN, FEIN or SSN

Spouse’s Signature

Date

Preparer’s Business Name (print or type)

Preparer’s Business Address (print or type)

By checking this box, I authorize Treasury to discuss my return with my preparer.

Line-by-Line Instructions for Parts 1 and 2

Enter the domestic production activities deduction (DPAD) as

Note: The Michigan NOL is generally carried back two years. See

Line 20:

instructions, page 4, for exceptions.

calculated on line 12e.

Part 2: Redetermining Your Michigan Income Tax

Part 1: Computing Net Operating Loss

Line 25: Include any additions from Michigan Schedule 1. Also include

To complete Part 1, use the entries on your U.S. Form 1040 for the year the

DPAD attributable to Michigan.

loss occurred. Do not consider income and losses from other states, income

and losses from oil and gas production, or net operating loss deductions

Line 27: Include any subtractions from Michigan Schedule 1.

(NOLD) from other years.

Line 30: If line 30 is less than zero, carry amount to line 29 in the next

column. This amount cannot exceed line 29 of the preceding column.

Line 10: Miscellaneous income includes state and local refunds,

unemployment benefits, alimony received and any other miscellaneous

Line 34: Enter the total of nonrefundable credits claimed on your original

taxable income.

return.

Line 36a: Enter the total of refundable credits for homestead property tax,

Line 14: Subtract line 13 from line 11. This amount should equal your

federal AGI if you have no income or losses from other states, income and

farmland preservation and any other refundable credits claimed for the tax

losses from oil and gas production, or net operating loss deductions from

year(s) you are carrying the loss. Any credit entered here must be adjusted for

other years.

the NOLD adjustment to household income, if applicable. Be sure to attach

your amended credit form.

Line 19: The excess capital loss must be calculated on a U.S. Form 1045

Line 36c: For the year listed on line 23, enter total tax paid with the annual

Schedule A, line 21 or 22, then entered on this line.

return plus any additional tax paid after original return was filed.

Mail your completed form to: Michigan Department of Treasury

Lansing, MI 48956

+

0000 2013 73 02 27 8

1

1 2

2 3

3