Missouri Department Of Revenue

2014 Form MO-1040ES

Declaration Of Estimated Tax For Individuals

General Instructions

a) the tax shown on the preceding year’s return if that return was for a 12

1. F i l i n g r e q u i r e m e n t s — Y o u a r e r e q u i r e d t o f i l e a d e c l a r a t i o n o f

month period and showed a tax liability; or

estimated tax if your Missouri estimated tax is expected to be $100.00 or more

b) 90% (66 2/3% in the case of a farmer) of the total amount due for the

(Section 143.521.1,

RSMo).

current year.

2. Missouri estimated tax — Your Missouri estimated tax is the amount estimated to

be the income tax under

Chapter 143,

RSMo, for the tax year, less the amount

9. Rounding on Missouri Returns — You must round all cents to the nearest whole

dollar on your return. For cents .01 through .49, round down to the

which you estimate to be the sum of any credits allowable, including tax withheld.

previous whole dollar amount (round $32.49 down to $32.00) on the return. For

3. Farmers — If you have an estimated Missouri gross income from farming for

cents .50 through .99, round up to the next whole dollar amount (round $32.50

the tax year that equals at least two‑thirds of the total estimated

up to $33.00) on the return. For your convenience, the zeros have already been

Missouri gross income, you may file a declaration of estimated tax and make

placed in the cent columns on the returns.

payment at any time on or before January 15, or file an income tax return and

pay in full on or before March 1.

Instructions For Completing The Form MO‑1040ES

4. Payment of estimated tax — Your estimated tax may be paid in full with the first

Complete the estimated tax worksheet.

declaration voucher, or in equal installments on or before April 15, June 15,

Sep tem ber 15, and January 15. If the due date falls on a Saturday, Sunday, or

Form MO‑1040ES — Enter your name, spouse’s name, and addressing information.

legal holiday, the voucher will be considered timely if filed on the next business

1. Line 1 — Enter Your or Primary Social Security Number (SSN).

day. Actual due dates are printed on the vouchers. The first installment must

2. Line 2 — Enter the first four letters of your last name. See examples below.

accompany the first declaration voucher. If no declaration was required to be

filed during the tax year, no declaration need be filed on January 15, if you file a

Note: Please use all capital letters as shown.

voucher and pay the tax on or before January 31.

Name

Enter

Name

Enter

5. Nonresident — If you are a nonresident, your estimated tax requirement is

John Brown

BROW

Juan DeJesus

DEJE

the same as a resident. A nonresident’s tax is based on the proportion of the

Joan A. Lee

LEE

Jean McCarty

MCCA

adjusted gross income from Missouri sources. Example: An individual has

John O’Neill

ONEI

Pedro Torres‑Lopes

TORR

Missouri tax of $400 on all income, with 90% of the adjusted gross income from

3. Line 3 — If you are filing a joint return, enter your Spouse’s Social Security

Missouri; the Missouri estimated tax is $360 (90% of $400).

Number (SSN).

6. Changes in Income — Even though your Missouri estimated tax on April 15 is

4. Line 4 — Enter the amount shown on Line 18 of the estimated worksheet. This is

such that you are not required to file a declaration at that time, the Missouri

the amount of your in stall ment payment.

estimated tax may change so that you will be required to file at a later date.

The time for filing is as follows: June 15, if the change occurs after April 15, and

This is the amount of your installment payment. Mail with remittance (U.S. funds

before June 15, September 15, if the change occurs after June 15, but before

only), payable to the Missouri Department of Revenue, P.O. Box 555, Jefferson City,

September 15, January 15, if the change occurs after September 15. If the due

MO 65105‑0555. Be sure to include your Social Security Number on your check.

date falls on a Saturday, Sunday, or legal holiday, the voucher will be considered

If the declaration must be amended:

timely if filed on the next business day.

1. Complete the amended computation schedule on the next page.

7. Amended declaration — If, after you have filed a declaration, you find the

Missouri estimated tax substantially increased or de creased as a result

2. Enter the revised amounts on the remaining Form MO‑1040ES vouchers.

of a change in income, an amended declaration should be filed on or

3. Mail with remittance (U.S. funds only), payable to the Missouri Department of

before the next filing date. Please complete the Amended Estimated Tax

Revenue, P.O. Box 555, Jefferson City, MO 65105‑0555.

Worksheet and show the amended Missouri estimated tax on Line 1

of the next

Form MO-1040ES

filed.

8. Addition to tax for failure to pay estimated tax — The law provides an addition to

tax, determined at the present applicable rate of interest from the date of the first

installment underpaid. Interest will be charged on all delinquent payments. Access

our website at

for the current interest

rate. The charge does not apply to you if each installment is paid on time

and the total amount of all payments of estimated tax made on or

before the last date prescribed for payment of such installment equals or exceeds:

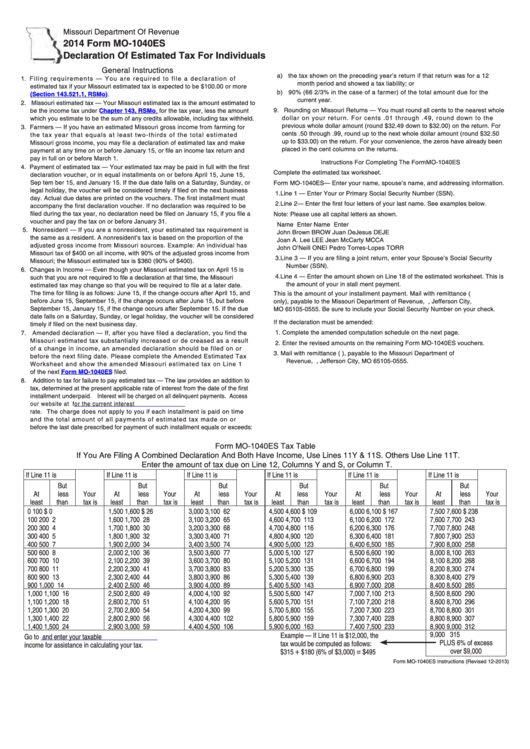

Form MO‑1040ES Tax Table

If You Are Filing A Combined Declaration And Both Have Income, Use Lines 11Y & 11S. Others Use Line 11T.

Enter the amount of tax due on Line 12, Columns Y and S, or Column T.

If Line 11 is

If Line 11 is

If Line 11 is

If Line 11 is

If Line 11 is

If Line 11 is

But

But

But

But

But

But

At

less

Your

At

less

Your

At

less

Your

At

less

Your

At

less

Your

At

less

Your

least

than

tax is

least

than

tax is

least

than

tax is

least

than

tax is

least

than

tax is

least

than

tax is

0

100

$ 0

1,500

1,600

$ 26

3,000

3,100

62

4,500

4,600

$ 109

6,000

6,100

$ 167

7,500

7,600

$ 238

100

200

2

1,600

1,700

28

3,100

3,200

65

4,600

4,700

113

6,100

6,200

172

7,600

7,700

243

200

300

4

1,700

1,800

30

3,200

3,300

68

4,700

4,800

116

6,200

6,300

176

7,700

7,800

248

300

400

5

1,800

1,900

32

3,300

3,400

71

4,800

4,900

120

6,300

6,400

181

7,800

7,900

253

400

500

7

1,900

2,000

34

3,400

3,500

74

4,900

5,000

123

6,400

6,500

185

7,900

8,000

258

500

600

8

2,000

2,100

36

3,500

3,600

77

5,000

5,100

127

6,500

6,600

190

8,000

8,100

263

600

700

10

2,100

2,200

39

3,600

3,700

80

5,100

5,200

131

6,600

6,700

194

8,100

8,200

268

700

800

11

2,200

2,300

41

3,700

3,800

83

5,200

5,300

135

6,700

6,800

199

8,200

8,300

274

800

900

13

2,300

2,400

44

3,800

3,900

86

5,300

5,400

139

6,800

6,900

203

8,300

8,400

279

900

1,000

14

2,400

2,500

46

3,900

4,000

89

5,400

5,500

143

6,900

7,000

208

8,400

8,500

285

1,000

1,100

16

2,500

2,600

49

4,000

4,100

92

5,500

5,600

147

7,000

7,100

213

8,500

8,600

290

1,100

1,200

18

2,600

2,700

51

4,100

4,200

95

5,600

5,700

151

7,100

7,200

218

8,600

8,700

296

1,200

1,300

20

2,700

2,800

54

4,200

4,300

99

5,700

5,800

155

7,200

7,300

223

8,700

8,800

301

1,300

1,400

22

2,800

2,900

56

4,300

4,400

102

5,800

5,900

159

7,300

7,400

228

8,800

8,900

307

1,400

1,500

24

2,900

3,000

59

4,400

4,500

106

5,900

6,000

163

7,400

7,500

233

8,900

9,000

312

9,000

315

Example — If Line 11 is $12,000, the

Go to

and enter your taxable

PLUS 6% of excess

tax would be computed as follows:

income for assistance in calculating your tax.

+

=

over $9,000

$315

$180 (6% of $3,000)

$495

Form MO‑1040ES Instructions (Revised 12‑2013)

1

1 2

2