Page 2

EFO00046 11-05-12

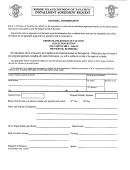

Idaho Payment Agreement Request Instructions

The Idaho State Tax Commission understands that it may not

What will happen next year if I have a refund coming

always be possible to pay your state taxes on time. We offer this

and I’m still making payments?

Any state or federal tax refund you are due may be applied to the

payment agreement to help you pay your taxes and comply with the

taxes you owe. However, your monthly payments will still be

law. If you can’t pay the full amount of the Idaho income taxes you

deducted if a balance remains.

owe and want to sign up for this plan, you must:

Complete and return a financial statement; and

Why are you requiring automatic withdrawal payments?

File all prior year tax returns that have not yet been

With automatic withdrawal, we are not required to monitor your

filed; and

payments; they are automatic and the state is not at risk unless you

Agree to file and pay all future taxes on time. This

default.

means you must have enough income tax withheld

from your pay to equal the amount you owe when you

file your returns. If you don’t do this, we’ll stop your

How can I make sure that I don’t have a future liability?

Contact your employer to adjust your W-4 form to make sure

payment agreement and begin collecting any unpaid

enough money is being withheld. You may also make voluntary

balance you owe for all tax years. This may include

estimated payments.

a levy on your wages or bank accounts, or seizure of

assets.

What happens if I owe again next year?

In addition, we’ll file a tax lien and penalty and interest will

If you don’t pay your debt in full when you file next year, this

continue to accrue, even though you’re in a payment agreement.

payment agreement will be in default and we’ll begin action to

collect the remaining balance. This may include a levy on your

wages or bank accounts, or seizure of assets.

Common Questions

Where can I find my bank routing number and account

How soon will I hear from you?

number?

We’ll respond to your request within 30 days. If your request is

approved, we’ll send you a notice that shows your payment amount

and the date(s) of the withdrawal(s). Also, we’ll continue to send

you our billing letters, including a Notice of State Tax Lien.

What is a tax lien and why will you file it?

We’ll file a tax lien to protect the state’s interest. A lien attaches to

all property you own and secures the state’s right to the property if

you default on your payment agreement. The lien is recorded with

the Secretary of State’s office and appears on your credit report.

We’ll release the lien after you pay your tax debt.

Why should I make my payments as large as possible?

Penalty and interest charges apply to the tax you owe. These

charges are added to the amount you owe until your balance is paid

What happens if I need to change my banking

in full. The sooner you pay the debt, the less penalty and interest

information?

you will owe. You may also send additional payments at any time

We must receive your new information three weeks before your

to apply to this liability.

normal withdrawal date in order to meet bank deadlines. Send

a voided check or savings account deposit slip from your new

What happens if I don’t have enough money in my bank

account, along with a letter explaining the change, to: Attn: 40PA,

Idaho State Tax Commission, PO Box 36, Boise ID 83722-0410.

account?

If there isn’t enough money in your account to cover your

payment, we’ll cancel your payment agreement, and charge a $20

What if I want payments withdrawn from my savings

return check processing fee. We’ll also send you a default notice

account?

requiring full payment within 20 days. If you don’t pay, we’ll

Instead of sending a voided check, send a voided deposit slip that

begin collection action, which may include a levy on your wages or

includes your routing number and account number, or send a letter

bank accounts, or seizure of assets. Note: Automatic withdrawals

from your bank verifying the routing number and account number.

are made before the start of the business day. Remember to make

any deposits to cover these withdrawals on the day before the

What if I have questions?

withdrawal date.

If you’d like to learn more about the Idaho Payment Agreement

Request, call us toll free at (800) 972-7660 ext. 7633, or 334-7633

in the Boise area.

1

1 2

2 3

3 4

4