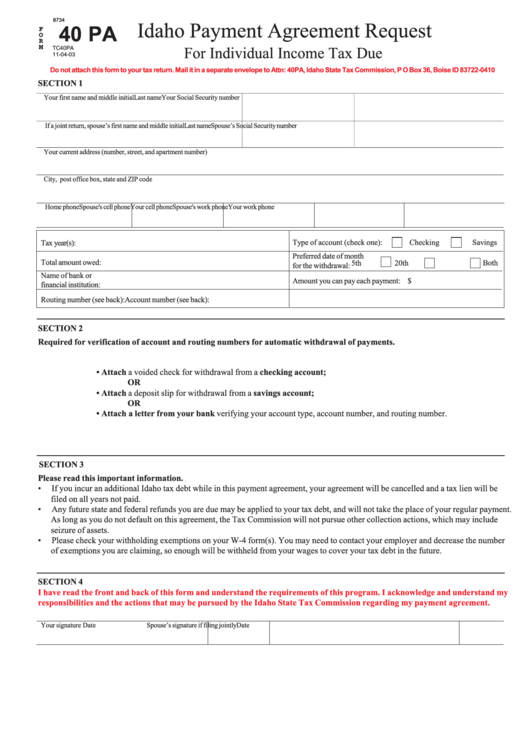

8734

Idaho Payment Agreement Request

40 PA

F

O

R

M

For Individual Income Tax Due

TC40PA

11-04-03

Do not attach this form to your tax return. Mail it in a separate envelope to Attn: 40PA, Idaho State Tax Commission, P O Box 36, Boise ID 83722-0410

SECTION 1

Your first name and middle initial

Last name

Your Social Security number

If a joint return, spouse’s first name and middle initial

Last name

Spouse’s Social Security number

Your current address (number, street, and apartment number)

City, post office box, state and ZIP code

Home phone

Your work phone

Spouse's work phone

Your cell phone

Spouse's cell phone

Type of account (check one):

Checking

Savings

Tax year(s):

Preferred date of month

Total amount owed:

5th

20th

Both

for the withdrawal:

Name of bank or

Amount you can pay each payment: $

financial institution:

Routing number (see back):

Account number (see back):

SECTION 2

Required for verification of account and routing numbers for automatic withdrawal of payments.

• Attach a voided check for withdrawal from a checking account;

OR

• Attach a deposit slip for withdrawal from a savings account;

OR

• Attach a letter from your bank verifying your account type, account number, and routing number.

SECTION 3

Please read this important information.

•

If you incur an additional Idaho tax debt while in this payment agreement, your agreement will be cancelled and a tax lien will be

filed on all years not paid.

•

Any future state and federal refunds you are due may be applied to your tax debt, and will not take the place of your regular payment.

As long as you do not default on this agreement, the Tax Commission will not pursue other collection actions, which may include

seizure of assets.

•

Please check your withholding exemptions on your W-4 form(s). You may need to contact your employer and decrease the number

of exemptions you are claiming, so enough will be withheld from your wages to cover your tax debt in the future.

SECTION 4

I have read the front and back of this form and understand the requirements of this program. I acknowledge and understand my

responsibilities and the actions that may be pursued by the Idaho State Tax Commission regarding my payment agreement.

Your signature

Date

Spouse’s signature if filing jointly

Date

1

1