Form St-5 - Sales Tax Exempt Purchaser Certificate Filing Example - Massachusetts Department Of Revenue

ADVERTISEMENT

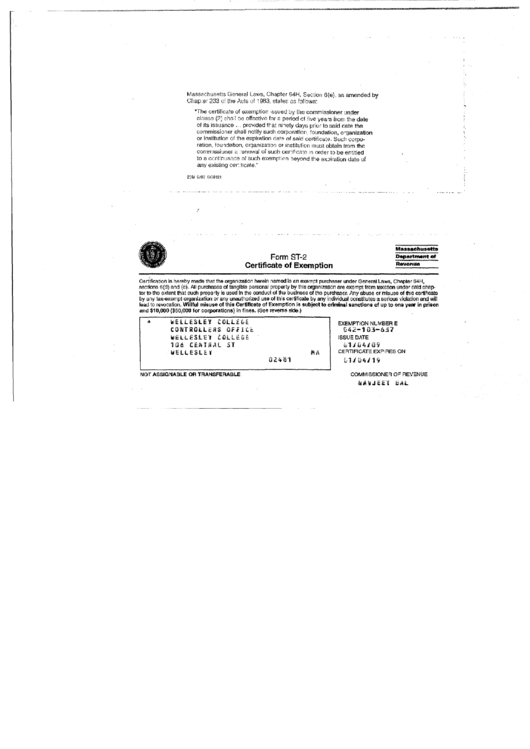

Massachusetts General Laws, Chapter 64H, Section 6(e), as amended by

Chapter 233 of the Acts of 1983, states as follows:

"The certificate of exemption issued by the commissioner under

clause (2) shall be effective for a period of five years from the date

of its issuance ... provided that ninety days prior to said date the

commissioner shall notify such corporation, foundation, organization

or institution of the expiration date of said certificate. Such corpo

ration, foundation, organization or institution must obtain .from the

commissioner a mm;wal of such certificate in order to be entitled

to a continuance

o!

such exemption beyond the expiration date of

any existing certilicate."

25M 9/00 GC0121

"

.1

Form ST-2

Certificate of Exemption

Massachusetts

Department of

Revenue

Certification is hereby made that the organization herein named is an exempt purchaser under General Laws, Chapter 64H,

sections 6(d) and (e). All purchases of tangible personal property by this organization are exempt from taxation under said chap

ter to the extent that such property is used in the conduct of the business of the purchaser. Any abuse or misuse of this certificate

by any tax-exempt organization or any unauthorized use of this certificate by any individual constitutes a serious violation and will

lead to revocation. Willful misuse of this Certificate of Exemption Is subject to criminal sanctlo.ns of up to one year in prison

and $10,000 ($50,000 for corporations) in fines. (See reverse side.)

'*

~iLLESLEY

tOLLEiE

CONTROLLERS

Qff

ltt

WiLLESLEl £GLLE&E

106 CENTRAL ST

WELLESLEY

02481

MA

EXEMPTION NUMBER E

u-42-1 o3-o.37

ISSUE DATE

£1JLJ4J09

CERTIFICATE EXPIRES ON

L1J t:i4J 19

NOT ASSIGNABLE OR TRANSFERABLE

COMMISSIONER OF REVENUE

l.\AVJ .lH:T tl:Al

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3