Instructions For Form 10 - Oregon Underpayment Of Estimated Tax - 2014

ADVERTISEMENT

2014

OREGON

Form 10 and Instructions for

Underpayment of Estimated Tax

General information

Oregon law requires withholding or estimated tax payments as income is earned. Interest is charged if you underpay or are

late. Use this form to determine if you owe underpayment interest.

For more information on who must pay estimated taxes, see Form 40 ESV instructions.

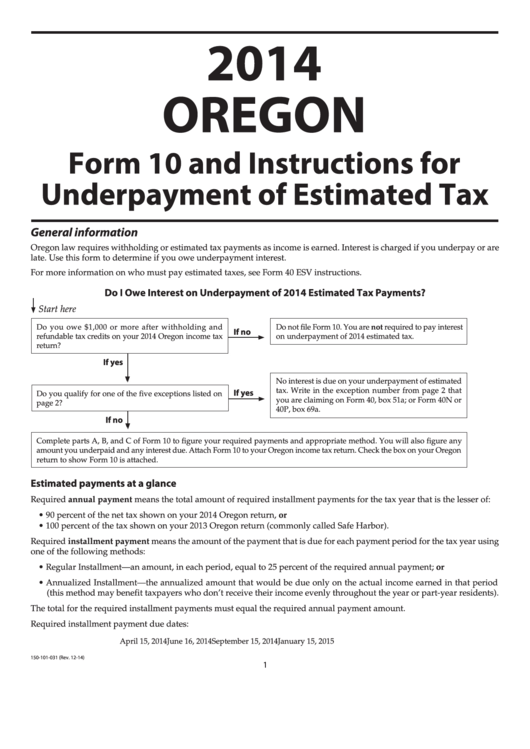

Do I Owe Interest on Underpayment of 2014 Estimated Tax Payments?

Start here

Do you owe $1,000 or more after withholding and

Do not file Form 10. You are not required to pay interest

If no

refundable tax credits on your 2014 Oregon income tax

on underpayment of 2014 estimated tax.

return?

If yes

No interest is due on your underpayment of estimated

tax. Write in the exception number from page 2 that

If yes

Do you qualify for one of the five exceptions listed on

you are claiming on Form 40, box 51a; or Form 40N or

page 2?

40P, box 69a.

If no

Complete parts A, B, and C of Form 10 to figure your required payments and appropriate method. You will also figure any

amount you underpaid and any interest due. Attach Form 10 to your Oregon income tax return. Check the box on your Oregon

return to show Form 10 is attached.

Estimated payments at a glance

Required annual payment means the total amount of required installment payments for the tax year that is the lesser of:

• 90 percent of the net tax shown on your 2014 Oregon return, or

• 100 percent of the tax shown on your 2013 Oregon return (commonly called Safe Harbor).

Required installment payment means the amount of the payment that is due for each payment period for the tax year using

one of the following methods:

• Regular Installment—an amount, in each period, equal to 25 percent of the required annual payment; or

• Annualized Installment—the annualized amount that would be due only on the actual income earned in that period

(this method may benefit taxpayers who don’t receive their income evenly throughout the year or part-year residents).

The total for the required installment payments must equal the required annual payment amount.

Required installment payment due dates:

April 15, 2014

June 16, 2014

September 15, 2014

January 15, 2015

150-101-031 (Rev. 12-14)

1

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8