Instructions For Form Ct-222 - Underpayment Of Estimated Tax By A Corporation - New York State Department Of Taxation And Finance - 2004

ADVERTISEMENT

New York State Department of Taxation and Finance

CT-222-I

Instructions for Form CT-222

Underpayment of Estimated Tax by a Corporation

Temporary increase in the mandatory first installment of

The second, third, and fourth installments of estimated franchise

tax and MTA surcharge are due on the fifteenth day of the sixth,

estimated tax

ninth, and twelfth months of your tax year.

For tax years beginning on or after January 1, 2003, and before

January 1, 2006, the Tax Law has been amended to provide an

Computation of underpayment

increase in the mandatory first installment from 25% of the

Complete lines 1 through 12 to determine any underpayment of

preceding year’s tax to 30%. This increase is for general business

estimated taxes.

corporations (Article 9-A), banking corporations (Article 32),

insurance corporations (Article 33), and entities subject to tax

Line 2 — Large corporations: Multiply the amount on line 1 by

under Article 9, sections 184, 186-a, or 186-e, whose preceding

100%. All others: Multiply line 1 by 91%. A large corporation is one

year’s tax, exclusive of the metropolitan transportation business tax

that had, or whose predecessor had, allocated entire net income

(MTA surcharge), exceeds $100,000. Taxpayers subject to the MTA

(ENI) of at least $1,000,000 for any of the three tax years

surcharge that are required to pay their first installment at the 30%

immediately preceding the tax year involved. Article 33 filers: For

rate must also calculate their estimated tax for the surcharge at

a nonlife insurance corporation subject to tax under Tax Law

30% of the preceding year’s MTA surcharge.

section 1502-a, a large corporation is one that had allocated ENI of

at least $1,000,000 for any of the three tax years immediately

Estimated tax payments required by partnerships,

preceding the tax year involved or had direct premiums, subject to

limited liability companies (LLCs), and New York

the premiums tax under Tax Law section 1502-a, exceeding

S corporations

$3,750,000 for any of the three preceding tax years beginning on

For tax years ending after December 31, 2002, all partnerships,

or after January 1, 2003.

LLCs that are treated as partnerships for federal purposes, or

Line 4 — See Payment of estimated tax above.

New York S corporations that had income from New York sources

are required to pay estimated taxes on behalf of nonresident

Line 8 — Corporate partners: Include amounts paid on time and

individuals and C corporation partners, members, or shareholders

on your behalf by a partnership. A payment of estimated tax is

on their distributive or pro rata share of the respective entities

applied against underpayments of required installments in the

income. See Form IT-2659, Estimated Tax Penalties for

order in which the installments are required to be paid.

Partnerships and New York S Corporations , to determine if you

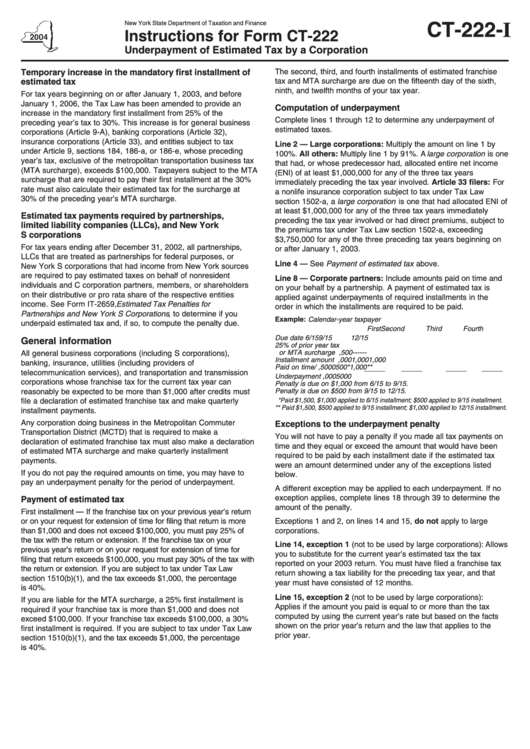

Example: Calendar-year taxpayer

underpaid estimated tax and, if so, to compute the penalty due.

First

Second

Third

Fourth

Due date ...........................

3/15

6/15

9/15

12/15

General information

25% of prior year tax

or MTA surcharge ...........

1,500

--

--

--

All general business corporations (including S corporations),

Installment amount due ....

--

1,000

1,000

1,000

banking, insurance, utilities (including providers of

Paid on time/credited ........

1,500

0

500*

1,000 **

telecommunication services), and transportation and transmission

Underpayment ..................

0

1,000

500

0

corporations whose franchise tax for the current tax year can

Penalty is due on $1,000 from 6/15 to 9/15.

Penalty is due on $500 from 9/15 to 12/15.

reasonably be expected to be more than $1,000 after credits must

* Paid $1,500, $1,000 applied to 6/15 installment; $500 applied to 9/15 installment.

file a declaration of estimated franchise tax and make quarterly

** Paid $1,500, $500 applied to 9/15 installment; $1,000 applied to 12/15 installment.

installment payments.

Any corporation doing business in the Metropolitan Commuter

Exceptions to the underpayment penalty

Transportation District (MCTD) that is required to make a

You will not have to pay a penalty if you made all tax payments on

declaration of estimated franchise tax must also make a declaration

time and they equal or exceed the amount that would have been

of estimated MTA surcharge and make quarterly installment

required to be paid by each installment date if the estimated tax

payments.

were an amount determined under any of the exceptions listed

If you do not pay the required amounts on time, you may have to

below.

pay an underpayment penalty for the period of underpayment.

A different exception may be applied to each underpayment. If no

exception applies, complete lines 18 through 39 to determine the

Payment of estimated tax

amount of the penalty.

First installment — If the franchise tax on your previous year’s return

or on your request for extension of time for filing that return is more

Exceptions 1 and 2, on lines 14 and 15, do not apply to large

than $1,000 and does not exceed $100,000, you must pay 25% of

corporations.

the tax with the return or extension. If the franchise tax on your

Line 14, exception 1 (not to be used by large corporations): Allows

previous year’s return or on your request for extension of time for

you to substitute for the current year’s estimated tax the tax

filing that return exceeds $100,000, you must pay 30% of the tax with

reported on your 2003 return. You must have filed a franchise tax

the return or extension. If you are subject to tax under Tax Law

return showing a tax liability for the preceding tax year, and that

section 1510(b)(1), and the tax exceeds $1,000, the percentage

year must have consisted of 12 months.

is 40%.

Line 15, exception 2 (not to be used by large corporations):

If you are liable for the MTA surcharge, a 25% first installment is

Applies if the amount you paid is equal to or more than the tax

required if your franchise tax is more than $1,000 and does not

computed by using the current year’s rate but based on the facts

exceed $100,000. If your franchise tax exceeds $100,000, a 30%

shown on the prior year’s return and the law that applies to the

first installment is required. If you are subject to tax under Tax Law

prior year.

section 1510(b)(1), and the tax exceeds $1,000, the percentage

is 40%.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2