DR-15SW

R. 01/15

Page 2

To order replacement coupon books: Call Taxpayer Services,

If the 20th falls on a Saturday, Sunday, state or federal holiday,

8 a.m. to 7 p.m., ET, Monday through Friday, excluding holidays,

your return must be postmarked or hand-delivered on the first

at 800-352-3671, or contact the service center nearest you.

business day following the 20th. You must file a return for

each reporting period, even if no solid waste taxes, fees, or

If your information is not printed on this return, write your

surcharges are due.

business name, address, certificate number, and reporting

Penalty and Interest: If you are late filing your return or paying

period in the spaces provided.

the taxes, fees, and surcharges due, add a late penalty of 10%

Electronic Filing and Payment: You can file and pay solid

of the net amount due, but no less than $50. If your payment

waste taxes, fees, and surcharges by using the Department’s

is late, you owe interest on the net amount due. Interest

convenient, free, and secure website or you may purchase

rates, including daily rates, are published in Tax Information

software from a vendor.

Publications (TIPs) that are updated semiannually on January 1

and July 1 each year and posted on our website.

Due Dates: Returns and payments are due on the 1st and late

after the 20th day of the month following each reporting period.

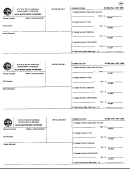

Dry-Cleaning Gross Receipts

,

.

Under penalties of perjury, I declare that I have read this return

A. Dry-Cleaning Gross Receipts

and the facts stated in it are true.

,

.

B. Less Exempt Receipts

Signature of Taxpayer

Date

Telephone #

,

.

C. Taxable Gross Receipts

Signature of Preparer

Date

Telephone #

,

.

1. Dry-Cleaning Gross Receipts Tax Due -

Multiply Taxable Gross Receipts by 2%(.02)

,

.

and enter this amount on Line 1

0

0

2. New Tire Fees Due

,

.

0

3. Lead-Acid Battery Fees Due

,

,

.

0 0

4. Rental Car Surcharge Due

,

,

.

5. Total Amount Due -

Bring amount to Line 5 on front of return.

Dry-Cleaning Gross Receipts

,

.

Under penalties of perjury, I declare that I have read this return

A. Dry-Cleaning Gross Receipts

and the facts stated in it are true.

,

.

B. Less Exempt Receipts

Signature of Taxpayer

Date

Telephone #

,

.

C. Taxable Gross Receipts

Signature of Preparer

Date

Telephone #

,

.

1. Dry-Cleaning Gross Receipts Tax Due -

Multiply Taxable Gross Receipts by 2%(.02)

,

.

and enter this amount on Line 1

0

0

2. New Tire Fees Due

,

.

0

3. Lead-Acid Battery Fees Due

,

,

.

0 0

4. Rental Car Surcharge Due

,

,

.

5. Total Amount Due -

Bring amount to Line 5 on front of return.

1

1 2

2