-

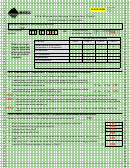

Form AEPC, Page 2 - 2012 SSN

OR FEIN

-

-

Part III. Credit Calculation (Partners in a partnership and shareholders of an S corporation)

Business Name of Partnership or S Corporation ____________________________________________

Federal Employer Identification Number ____________________________

9. Enter your portion of your Montana alternative energy production credit ....................................... 9.

10. Enter any remaining alternative energy production credit carryforward amount from previous

years ............................................................................................................................................. 10.

11. Add lines 9 and 10, and enter the result here. This is your total alternative energy production

credit for 2012 before limitation. Continue to Part IV .................................................................... 11.

Part IV. Credit Limitation (C corporations, individuals, partners in a partnership, and shareholders of an S

corporation)

12. Enter the net income attributable to eligible alternative energy equipment. If the alternative

energy production income is part of a business with both qualifying and nonqualifying income

sources, the Income Allocation Worksheet below must be used to calculate the amount for

this line ......................................................................................................................................... 12.

13. Enter your Montana taxable income (see instructions) ................................................................ 13.

14. Divide line 12 by line 13. Do not enter more than 1.0000 ............................................................ 14.

15. Enter the total tax as shown on your return (see instructions) ..................................................... 15.

16. Multiply line 14 by line 15. This is the maximum alternative energy product credit you are

allowed for 2012 ........................................................................................................................... 16.

17. Enter here, and on your return, the smaller of either line 16 or line 8 from Part II; or the

smaller of either line 16 and line 11 from Part III (depending on which Part you were required

to complete). This is your alternative energy production credit for 2012. ............................. 17.

Income Allocation Worksheet

c. Factor (b)

b. Montana

a. Total Factors

divided by

Factors

(a)=(c)

18. Business property

Alternative energy related property

18.

19. Business payroll

Alternative energy related payroll

19.

20. Business sales

Alternative energy related sales

20.

21. Enter the sum of the factors from lines 18, 19 and 20 .................................................................. 21.

22. Divide line 21 by the number of factors entered in column a, lines 18, 19 and 20 ....................... 22.

23. Enter the net income of the business (see instructions) ............................................................... 23.

24. Multiply the amount on line 23 by the amount on line 22. This is your net income attributable

to eligible alternative energy equipment ....................................................................................... 24.

●

C corporations and individuals. Enter this amount on line 12 of Part IV.

●

S corporations and partnerships. Each owner’s distributive share of this amount should be reported on Montana

Schedule K-1. Do not complete lines 12 through 17 of Part IV.

Where to Report Your Credit

► Individuals: Form 2, Schedule V

► S corporations: Form CLT-4S, Schedule II

► C corporations: Form CLT-4, Schedule C

► Partnerships: Form PR-1, Schedule II

If you file your Montana tax return electronically, you do not need to mail this form to us unless we ask you for a copy. When you file electronically,

you represent that you have retained the required documents in your tax records and will provide them upon the department’s request.

*12HN0201*

*12HN0201*

1

1 2

2 3

3 4

4