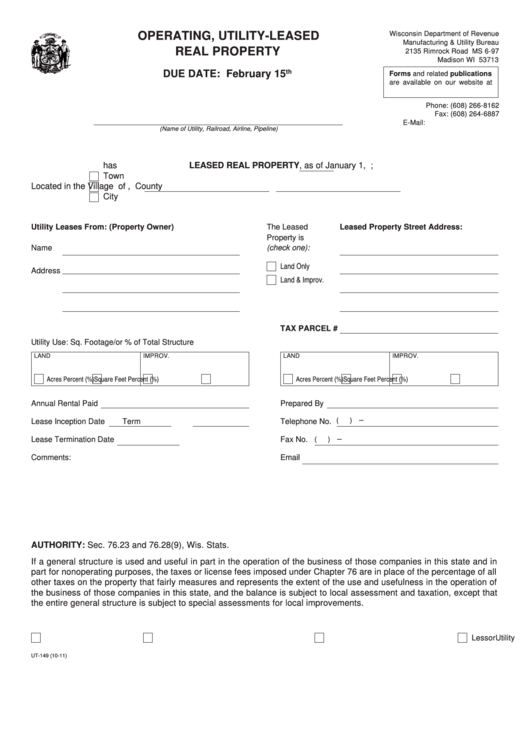

Form Ut-149 - Operating, Utility-Leased Real Property

ADVERTISEMENT

OPERATING, UTILITY-LEASED

Wisconsin Department of Revenue

Manufacturing & Utility Bureau

REAL PROPERTY

2135 Rimrock Road MS 6‑97

Madison WI 53713

th

DUE DATE: February 15

Forms and related publications

are available on our website at

Phone: (608) 266‑8162

Fax: (608) 264‑6887

E‑Mail: utility@revenue.wi.gov

(Name of Utility, Railroad, Airline, Pipeline)

has LEASED REAL PROPERTY, as of January 1,

;

Town

Located in the

Village of

,

County

City

Utility Leases From: (Property Owner)

The Leased

Leased Property Street Address:

Property is

Name

(check one):

Land Only

Address

Land & Improv.

TAX PARCEL #

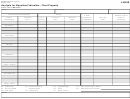

Utility Use: Sq. Footage/or % of Total Structure

LAND

IMPROV.

LAND

IMPROV.

Acres

Percent (%)

Square Feet

Percent (%)

Acres

Percent (%)

Square Feet

Percent (%)

Annual Rental Paid

Prepared By

–

(

)

Lease Inception Date

Term

Telephone No.

–

Lease Termination Date

Fax No.

(

)

Comments:

Email

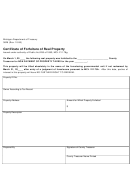

AUTHORITY: Sec. 76.23 and 76.28(9), Wis. Stats.

If a general structure is used and useful in part in the operation of the business of those companies in this state and in

part for nonoperating purposes, the taxes or license fees imposed under Chapter 76 are in place of the percentage of all

other taxes on the property that fairly measures and represents the extent of the use and usefulness in the operation of

the business of those companies in this state, and the balance is subject to local assessment and taxation, except that

the entire general structure is subject to special assessments for local improvements.

Utility

Manufacturing & Utility Bureau

Local Assessor

Lessor

UT‑149 (10‑11)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2