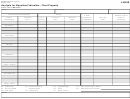

Form Ut-149 - Operating, Utility-Leased Real Property Page 2

ADVERTISEMENT

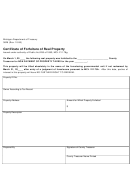

Instructions for Completing Form UT-149

Operating Utility Leased

Real Property

Filers

Please note: each property that is leased and

reported to the Department of Revenue (DOR)

All property owned and leased by public service

must have the tax parcel I.D. number.

corporations and used in their operations is subject to

state assessment under Chapter 76 of the Wisconsin

This number can be obtained from the property owner

or from the local assessor. Any form filed without this

Statutes. Form UT‑149, "Leased Real Property," is

provided to coordinate the reporting of property leased

number will be returned for completion.

to such corporations. It is particularly important in

controlling the assessment of "dual‑use property",

(1) Copy to the lessor,

subject to both Ch. 70 and Ch. 76 jurisdiction (for

part non‑utility and part utility use).

(2) Copy to the Local Assessor,

find the local assessor at

Filing Requirements

(Wisconsin Municipal Assessor List)

If real property is leased and used in the opera-

(3) Copy to the Department of Revenue,

tions of the utility, complete a form UT-149 by

Manufacturing & Utility Bureau

February 15.

2135 Rimrock Road MS 6‑97

Madison WI 53713

Failure to report leased real property to the local

assessor may result in such property being taxed

(4) Keep a copy for the corporation's records.

both locally and under Chapter 76.

For taxpayers that have previously submitted UT‑149

It is the corporation's obligation to prevent this from

forms, a listing of the reported properties will be sent

happening. Go to the following site for the name

with the October billing notice. Please update this

and address of the local assessor for the property

list with respect to any changes or cancellations of

being listed.

leases that have occurred, including the tax parcel

I.D. number and return the listing to DOR by the

due date.

(Wisconsin Municipal Assessor List)

List these properties in the appropriate section of the

Complete a UT‑149 for new leases and newly

annual report filed for gross revenues or ad valorem

cancelled leases by the due date. Obtain a 30‑day

tax purposes.

extension for filing, by electronically applying for an

extension before the due date at:

For any questions regarding this report, please call

608‑266‑8162 or e‑mail utility@revenue.wi.gov.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2