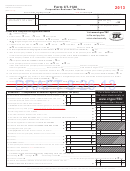

Form Ct-1120cr - Combined Corporation Business Tax Return - 2013 Page 6

ADVERTISEMENT

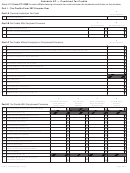

Schedule KC — Combined Tax Credits

Attach 2013 Form CT-1120K for each affiliate claiming a business tax credit and enter the combined credit totals on this schedule.

Part I - Tax Credits From 2013 Income Year

A

Part I-A Financial Institutions Tax Credit

Amount Applied

00

1.

Financial Institutions

A

B

Part I-B Tax Credits With Carryback Provisions

Amount Applied

Carryback Amount

00

00

2.

Neighborhood Assistance

00

00

3.

Housing Program Contribution

00

00

4.

Total Part I-B: Add Line 2 and Line 3 in Column A and Column B.

A

Part I-C Tax Credits Without Carryback or Carryforward Provisions

Amount Applied

5.

Apprenticeship Training

00

00

6.

Manufacturing Facility Credit for Facilities Located in a Targeted Investment Community/Enterprise Zone

7.

Computer Donation

00

8.

Grants to Institutions of Higher Education

00

00

9.

Machinery and Equipment

10. Qualified Small Business Job Creation

00

00

11.

Displaced Worker or Displaced Electric Worker

00

12. Service Facility

13. New Jobs Creation

00

14. Reserved for future use

00

15. Film Production

00

16. Digital Animation

00

17. Film Production Infrastructure

18. Job Expansion

00

00

19. Total Part I-C: Add Lines 5 through 18.

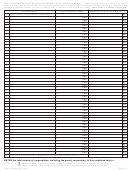

A

B

C

D

Carryforward Amount

2013 Credit

Amount Applied to

Carryforward

From Previous

Amount

2013 Corporation

Amount

Part I-D Tax Credits With Carryforward Provisions

Income Years

Claimed

Business Tax

to 2014

00

00

00

20. Housing Program Contribution: See instructions.

21. Reserved for future use

00

00

00

00

22. Research and Experimental Expenditures

00

00

00

00

23. Research and Development

00

00

00

00

24. Fixed Capital Investment

00

00

00

00

25. Human Capital Investment

00

00

00

00

26. Insurance Reinvestment Fund

00

00

00

00

27. Small Business Administration Guaranty Fee

00

00

00

00

28. Historic Homes Rehabilitation

00

00

00

00

29. Donation of Land

00

00

00

00

30. Historic Structures Rehabilitation

00

00

00

00

31. Historic Preservation

00

00

00

00

32. Urban and Industrial Site Reinvestment

00

00

00

00

33. Green Buildings

34. Reserved for future use

35. Total Part I-D: Add Lines 20 through 33

00

00

00

00

in Columns A through D.

Form CT-1120CR (Rev. 12/13)

Page 6 of 7

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7