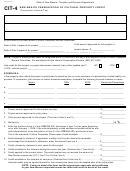

CIT-5

NEW MEXICO QUALIFIED BUSINESS FACILITY REHABILITATION CREDIT

Rev 06/25/2013

INSTRUCTIONS

page 1

ABOUT THIS CREDIT: The credit for qualified business facility rehabilitation is 50% of the costs of a project for the restora-

tion, rehabilitation or renovation of qualified business facilities. Claims are limited to three consecutive years and shall not

exceed $50,000. Any portion of the credit that remains unused at the end of the taxpayer's reporting period may be carried

forward for four consecutive years. Each claim for a qualified business facility rehabilitation credit must be accompanied by

certification from the New Mexico Enterprise Zone Program Officer.

A taxpayer who files a New Mexico corporate income and franchise tax return or a sub-chapter S corporate income and

franchise tax return and who is the owner of a qualified business facility may claim the credit. A member/owner of a partner-

ship, LLC, S corporation, joint venture or similar business association that has qualified for the qualified business facility

rehabilitation credit may claim the credit in proportion to the taxpayer's interest in the business association. The member/

owner must complete Schedule A.

A taxpayer may claim this credit if:

1. the taxpayer submitted a plan and specifications for restoration, rehabilitation or renovation to the New Mexico Enter-

prise Zone Program Officer and received approval; and

2. the taxpayer received certification from the New Mexico Enterprise Zone Program Officer after completing the restora-

tion, rehabilitation or renovation that it conformed to the plan and specifications.

"Qualified business facility" means a building located in a New Mexico enterprise zone that is suitable for use and is put into

service by a person in the manufacturing, distribution or service industry immediately following the restoration, rehabilita-

tion or renovation project; provided, the building must have been vacant for the 24-month period immediately preceding the

commencement of the restoration, rehabilitation or renovation project.

"Restoration, rehabilitation or renovation" includes the construction services necessary to ensure that a building is in compli-

ance with applicable zoning codes, is safe for occupancy, and meets the operating needs of a person in the manufacturing

distribution or service industry; and expansion of or an addition to a building if the expansion or addition does not increase

the usable square footage of the building by more than 10% of the usable square footage of the building prior to the restora-

tion, rehabilitation or renovation project.

NOTE: No qualified business facility rehabilitation credit is allowed for cultural or historic properties nor for costs qualifying

for credit under the Investment Credit Act.

HOW TO COMPLETE THIS FORM: Complete all information requested in the address block. Enter the date of the proj-

ect approval and the date of the credit approval. Also enter the project approval number and the amount of the credit ap-

proved.

Schedule A. Complete this section if the project is owned by one or more members/owners of a partnership, limited liability

corporation, S corporation, joint venture or similar business association. If additional space is needed, attach a separate

page.

Line 1.

Enter the amount of the project that was approved for the current tax year.

Line 2.

Enter the amount approved for the project in prior tax years, if applicable.

Line 3.

Enter the sum of lines 1 and 2. This is the total amount approved for this project.

Line 4.

Multiply line 3 by 50%.

Line 5.

Enter the product of line 3 x line 4 or $50,000 whichever is less.

Line 6.

Credit allowed for claimant. If applicable, multiply line 5 by the claimant's ownership percentage from Schedule

A. If one or more members/owners of a partnership, limited liability corporation, S corporation, joint venture or

similar business association own the property upon which the project is performed, the claimant may only claim an

amount of a credit in proportion to the claimant's interest in the business association. The claimant is the taxpayer

who is filing the New Mexico income tax return and claiming the credit on their return.

Line 7.

Credit claimed by the claimant in prior years for this project. Enter the amount of credit claimed in previous

years, for this project.

1

1 2

2 3

3