INSTRUCTIONS FOR TIRE EXCISE TAX RETURN

LINE 1 — Number of New Tires Sold for Vehicles. Enter on line 1 the total number of new tires sold for vehicles during the

reporting period. Also include all new tires mounted on new or used vehicles sold at retail for the first time and all new tires for use

on automobiles, buses, trucks, truck tractors, trailers, farm machinery, construction equipment, and motorcycles. Do not include

new tires sold for use on vehicles not authorized or allowed to operate on public streets and highways or used, recapped, or

retreaded tires.

LINE 2 — Tax Due. Multiply line 1 by $.25 (twenty-five cents).

LINE 3 — Penalty & Interest. Penalty and interest are due if the return is not filed by the due date. Penalty is computed at 10% of

the tax due for delinquent payment of tax if paid within sixty days (60) of the due date and 25% on the balance due if payment is

received after sixty days (60) of the due date. Interest is computed on the tax due for each month or any portion of a month that the

tax remains unpaid. For information about current or prior penalty and interest rates, consult our web site:

LINE 4 — Credit Memorandum. Use line 4 to deduct any allowable credits from prior tire excise tax returns. A credit memorandum

issued by the Kansas Department of Revenue must accompany the tire excise tax return to support any tire excise tax credit.

LINE 5 — Total Amount Due. Add lines 2 and 3, then subtract line 4 and enter the result.

Sign the completed return and mail it with your remittance on or before the due date. Make your check or money order for the tax

due on line 5 payable to "Tire Excise Tax.” Be sure to write your Tire Excise Tax account number and tax period on your check or

money order.

For additional information, address your inquiries to Kansas Department of Revenue, Miscellaneous Tax, 915 SW Harrison St.,

Topeka, Kansas 66612-1588, or call (785) 368-8222.

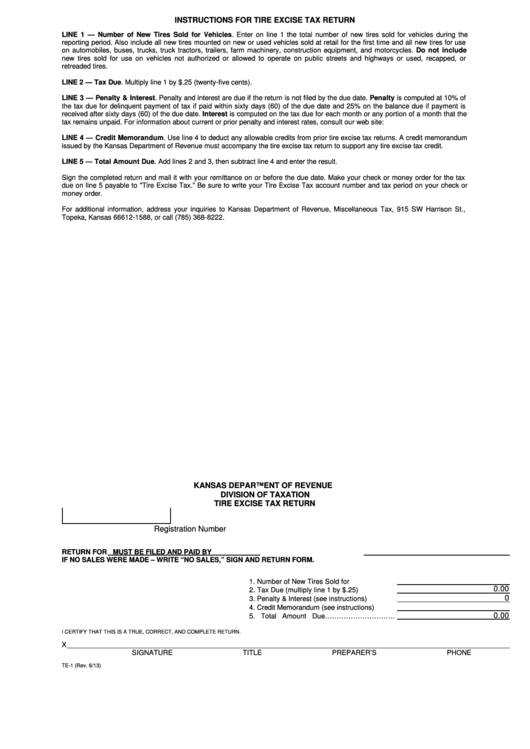

KANSAS DEPARTMENT OF REVENUE

DIVISION OF TAXATION

TIRE EXCISE TAX RETURN

Registration Number

RETURN FOR

MUST BE FILED AND PAID BY

IF NO SALES WERE MADE – WRITE “NO SALES,” SIGN AND RETURN FORM.

1. Number of New Tires Sold for Vehicles....

0.00

2. Tax Due (multiply line 1 by $.25)..............

0

3. Penalty & Interest (see instructions).........

4. Credit Memorandum (see instructions) ....

0.00

5. Total Amount Due…………………………

I CERTIFY THAT THIS IS A TRUE, CORRECT, AND COMPLETE RETURN.

X

SIGNATURE

TITLE

PREPARER’S PHONE NUMBER

TE-1 (Rev. 6/13)

1

1