Form Rct-106 - Insert Sheet Page 2

Download a blank fillable Form Rct-106 - Insert Sheet in PDF format just by clicking the "DOWNLOAD PDF" button.

Open the file in any PDF-viewing software. Adobe Reader or any alternative for Windows or MacOS are required to access and complete fillable content.

Complete Form Rct-106 - Insert Sheet with your personal data - all interactive fields are highlighted in places where you should type, access drop-down lists or select multiple-choice options.

Some fillable PDF-files have the option of saving the completed form that contains your own data for later use or sending it out straight away.

ADVERTISEMENT

RCT-106 (07-12) (FI)

1060012205

Page 2

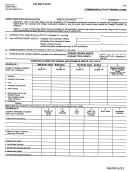

TABLES SUPPORTING DETERMINATION OF APPORTIONMENT

TAX PERIODS BEGINNING ON OR AFTER JAN. 1, 2010

PERCENTAGE (USE WHOLE DOLLARS ONLY)

Apportionment for:

o

o

o

Capital Stock/Foreign Franchise and Corporate Net Income Taxes

Capital Stock/Foreign Franchise Tax Only

Corporate Net Income Tax Only

TAX YEAR

BEGINNING

TAX YEAR

CORPORATION NAME

REVENUE ID

ENDING

TABLE 1 - PROPERTY FACTOR

Description

Inside PA

Inside and Outside PA

Beginning of Period

End of Period

Beginning of Period

End of Period

Tangible Property Owned (original cost value)

Inventory . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Buildings and Depreciable Assets . . . . . . . . . . . . . . . . . . . . . .

Land . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other Real and Tangible Personal Property . . . . . . . . . . . . . . .

Partner’s Share of Property Owned by Partnerships . . . . . . . . .

Less Construction in Progress (if included above) . . . . . . . . . . (

) (

)

(

) (

)

Totals . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Beginning and End of Period . . . . . . . . . . . . . . . . . . . . . . . .

Average Value (1/2 of Above) . . . . . . . . . . . . . . . . . . . . . . . . . . .

Add: Corporate Tangible and/or Real Property Rented* . . . . . . . .

Partnership Tangible and/or Real Property Rented* . . . . . . .

Total Average Value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (A)

(B)

*Eight times net annual rental rate (Attach schedule.)

Carry (A), (B) and (C) over to RCT-101,

(C) Property factor (Divide A by B; calculate to six decimal places.)

●

Schedule A-1, as applicable, Lines 1A, 1B and 1C.

Carry (A), (B) and (D) over to RCT-101,

(D) 5 times property factor (Divide A by B; calculate to

●

Schedule C-1, Lines 1A, 1B and 1C.

six decimal places and multiply by 5.)

Inside and Outside PA

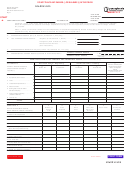

TABLE 2 - PAYROLL FACTOR

Description

Inside PA

Wages, salaries, commissions and other compensation

to employees in:

Cost of goods sold . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Compensation of officers . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Salesmen’s salaries and commissions . . . . . . . . . . . . . . . . . . .

Other payroll . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Partner’s Share of Payroll from Partnerships . . . . . . . . . . . . . . . . .

Total Payroll . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (A)

(B)

Carry (A), (B) and (C) over to RCT-101,

(C) Payroll factor (Divide A by B; calculate to six decimal places.)

●

Schedule A-1, as applicable, Lines 2A, 2B and 2C.

Carry (A), (B) and (D) over to RCT-101,

(D) 5 times payroll factor (Divide A by B; calculate to

●

Schedule C-1, Lines 2A, 2B and 2C.

six decimal places and multiply by 5.)

TABLE 3 - SALES FACTOR

Description

Inside PA

Inside and Outside PA

Sales (net of returns and allowances) . . . . . . . . . . . . . . . . . . . . .

Interest, Rents, Royalties . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Gross Receipts from the sale of other business assets

(except securities), unless you are a securities dealer . . . . . . . . . .

Other Sales (receipts only) . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Partner’s Share of Sales from Partnerships . . . . . . . . . . . . . . . . . .

Total Sales . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . (A)

(B)

,

Carry (A), (B) and (C) over to RCT-101

(C) Sales factor (Divide A by B; calculate to six decimal places.)

●

Schedule A-1, as applicable, Lines 3A, 3B and 3C.

(D) 90 times sales factor (Divide A by B; calculate to

●

Carry (A), (B) and (D) over to RCT-101,

six decimal places and multiply by 90.)

Schedule C-1, Lines 3A, 3B and 3C.

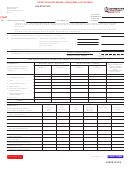

Special Apportionment to be completed only by railroad, truck, bus and airline companies; pipeline or natural gas companies; and water transportation

companies. Refer to instructions.

(A) NUMERATOR

(A)

●

(C)

=

(B) DENOMINATOR

(B)

.

Carry (A), (B) and (C) over to RCT-101, Schedules C-1 and/or A-1, as applicable, Lines 4A, 4B and 5

1060012205

PRINT FORM

Reset Entire Form

RETURN TO PAGE ONE

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2