Dor Form 82051 - Property Tax Form - Railroad Companies - 2014 Page 10

ADVERTISEMENT

.

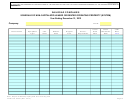

BY SIGNING THE VERIFICATION PAGE, THE TAXPAYER WAIVES ALL CONFIDENTIALITY REQUIREMENTS OF A.R.S.

42-2001 THROUGH 42-2004 WITH RESPECT

TO THIS PAGE AND CONSENTS TO THE DISCLOSURE OF THE CONTENTS OF THIS PAGE TO COUNTY ASSESSOR PERSONNEL BY THE ARIZONA DEPARTMENT OF

REVENUE.

RAILROAD COMPANIES

SCHEDULE OF NON-CAPITALIZED LEASED OR RENTED OPERATING PROPERTY (SYSTEM)

Year Ending December 31, 2012

Company:

Tax ID:

Lease

Lease

Total

Lessor Name

Equipment

Year

Number

Original

Accum.

Start

Termination

Rent

Type

Built

Units

Cost

Depreciation

Date

Date

2012

Note: Report All leased property both short and long term

Page 10

DOR Form 82051 (Rev. 01/13)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13