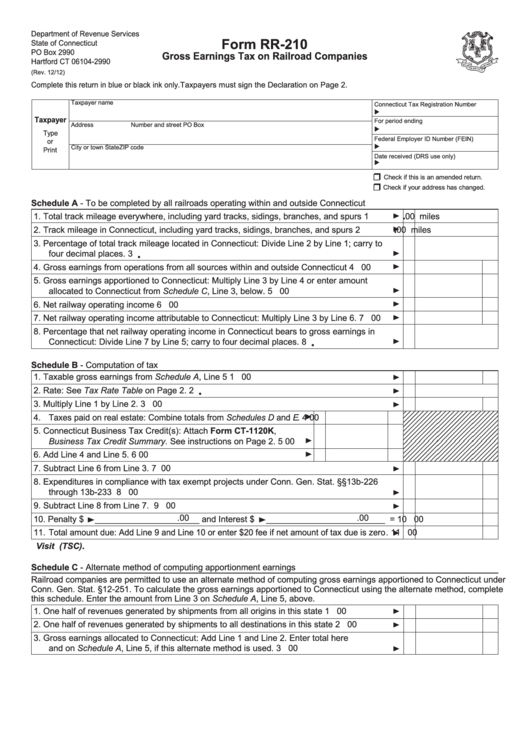

Form Rr-210 - Gross Earnings Tax On Railroad Companies

ADVERTISEMENT

Department of Revenue Services

Form RR-210

State of Connecticut

PO Box 2990

Gross Earnings Tax on Railroad Companies

Hartford CT 06104-2990

(Rev. 12/12)

Complete this return in blue or black ink only. Taxpayers must sign the Declaration on Page 2.

Taxpayer name

Connecticut Tax Registration Number

Taxpayer

For period ending

Address

Number and street

PO Box

Type

Federal Employer ID Number (FEIN)

or

City or town

State

ZIP code

Print

Date received (DRS use only)

Check if this is an amended return.

Check if your address has changed.

Schedule A - To be completed by all railroads operating within and outside Connecticut

1. Total track mileage everywhere, including yard tracks, sidings, branches, and spurs

1

00 miles

•

2. Track mileage in Connecticut, including yard tracks, sidings, branches, and spurs

2

00 miles

•

3. Percentage of total track mileage located in Connecticut: Divide Line 2 by Line 1; carry to

four decimal places.

3

•

4. Gross earnings from operations from all sources within and outside Connecticut

4

00

5. Gross earnings apportioned to Connecticut: Multiply Line 3 by Line 4 or enter amount

allocated to Connecticut from Schedule C, Line 3, below.

5

00

6. Net railway operating income

6

00

7. Net railway operating income attributable to Connecticut: Multiply Line 3 by Line 6.

7

00

8. Percentage that net railway operating income in Connecticut bears to gross earnings in

Connecticut: Divide Line 7 by Line 5; carry to four decimal places.

8

•

Schedule B - Computation of tax

1. Taxable gross earnings from Schedule A, Line 5

1

00

2. Rate: See Tax Rate Table on Page 2.

2

•

3. Multiply Line 1 by Line 2.

3

00

4. Taxes paid on real estate: Combine totals from Schedules D and E.

4

00

5. Connecticut Business Tax Credit(s): Attach Form CT-1120K,

Business Tax Credit Summary. See instructions on Page 2.

5

00

6. Add Line 4 and Line 5.

6

00

7. Subtract Line 6 from Line 3.

7

00

8. Expenditures in compliance with tax exempt projects under Conn. Gen. Stat. §§13b-226

through 13b-233

8

00

9. Subtract Line 8 from Line 7.

9

00

.00

.00

10. Penalty $

______________________ and Interest $

_________________________ = 10

00

11. Total amount due: Add Line 9 and Line 10 or enter $20 fee if net amount of tax due is zero.

11

00

.

Visit to make an electronic payment using the Taxpayer Service Center (TSC)

Schedule C - Alternate method of computing apportionment earnings

Railroad companies are permitted to use an alternate method of computing gross earnings apportioned to Connecticut under

Conn. Gen. Stat. §12-251. To calculate the gross earnings apportioned to Connecticut using the alternate method, complete

this schedule. Enter the amount from Line 3 on Schedule A, Line 5, above.

1. One half of revenues generated by shipments from all origins in this state

1

00

2. One half of revenues generated by shipments to all destinations in this state

2

00

3. Gross earnings allocated to Connecticut: Add Line 1 and Line 2. Enter total here

and on Schedule A, Line 5, if this alternate method is used.

3

00

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4