Dor Form 82051 - Property Tax Form - Railroad Companies - 2014 Page 8

ADVERTISEMENT

Confidential

ARIZONA DEPARTMENT OF REVENUE

TAX YEAR 2014

TAXPAYER NAME: _____________________

TAXPAYER NUMBER 51-______

PROPRIETARY INFORMATION

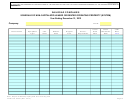

INCOME/EXPENSE DATA - SYSTEM

Year Ended

Year Ended

12/31/2012

12/31/2011

OPERATING REVENUES:

1.

TOTAL OPERATING REVENUES

2.

OTHER OPERATING INCOME - NET

OPERATING EXPENSES:

3.

OPERATING & MAINTENANCE EXPENSE

4.

DEPRECIATION & AMORTIZATION EXPENSE

5.

NON-CAPITALIZED LEASED PROPERTY RENTALS

6.

GENERAL & ADMINISTRATIVE EXPENSE

7.

INTEREST EXPENSE

8.

TOTAL OTHER TAXES (OTHER THAN INCOME TAXES)

TOTAL OPERATING EXPENSES

OPERATING INCOME

EBITDL (Earnings Before Interest, Taxes, Depreciation, and Lease Pymts.)

Comments:

NOTE: Explain any significant increase or decrease from the previous year in the comment section.

DOR Form 82051 (Rev. 01/13)

Page 8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13