Dor Form 82051 - Property Tax Form - Railroad Companies - 2014 Page 9

ADVERTISEMENT

Confidential

ARIZONA DEPARTMENT OF REVENUE

TAX YEAR 2014

TAXPAYER NAME: _____________________

TAXPAYER NUMBER 51-______

PROPRIETARY INFORMATION

ALLOCATION DATA

AS OF 12/31/2012

To Be Completed Only By Companies With Multi-State Operations

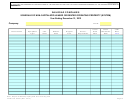

SYSTEM

ARIZONA

LAND VALUE

A. LAND VALUE

DISTRIBUTION OF COST:

1.

BUILDINGS AND STRUCTURES

2.

RAILROAD TRACK AND PROPERTY

3.

MACHINERY & EQUIPMENT (EXCLUDING LIC. TRANSPORT. EQUIP.)

4.

RAILWAY TRANSPORTATION EQUIPMENT

5.

FURNITURE AND FIXTURES

6.

CONSTRUCTION WORK IN PROGRESS

7.

MATERIALS & SUPPLIES

8.

NON-CAPITALIZED LEASED BUILDINGS AND STRUCTURES

9.

NON-CAPITALIZED LEASED EQUIPMENT

TOTAL COSTS-ITEMS A+ 1 THROUGH 9

OTHER FACTORS:

10.

REVENUE TON MILES

11.

TONS OF FREIGHT ORIGINATED

12.

TONS OF FREIGHT TERMINATED

13.

TONS OF FREIGHT RECEIVED

14.

TONS OF FREIGHT DELIVERED

Comments:

NOTE: Cost of equipment in Arizona shall be rolling stock owned or leased by respondent and in the state on the first day of

January of the valuation

year.

DOR Form 82051 (Rev. 01/13)

Page 9

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13