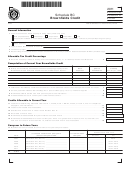

Schedule Rc - Research Credit - 2011 Page 2

ADVERTISEMENT

2

2011 SCHEDULE RC, PAGE 2

Part 2. Massachusetts Research Credit Used

The amount of the credit that may be used to reduce the excise is limited to 100% of the corporation’s first $25,000 of corporate excise liability

plus 75% of the corporation’s excise liability over $25,000. A single $25,000 amount applies to all members of an aggregate group, even if not

filing as Massachusetts combined group. Corporations that are not members of an aggregate group should enter the amount in line 1 in line 2

and 100% in line 3.

Is this schedule reporting a Life Science Research Credit under M.G.L. Ch. 63 sec. 38W?:

Yes

No

1

Total excise before credits for this corporation (from form 355, line 6, Form 355S, line 9 or Form 355U, line 24) 1

2

Total group excise before credit. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 2

3

Allocation percentage for the $25,000 excise bracket . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3

4

Corporation’s share of excise not subject to the 75% limitation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 4

5

Corporation’s excise subject to the 75% limitation. Subtract line 4 from line 1 . . . . . . . . . . . . . . . . . . . . . . . . . . . 5

6

75% of excise subject to limitation . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 6

7

Corporation’s subtotal of excise within the limitation. Add lines 4 and 6 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 7

8

Total of other credits applied against this corporation’s excise this year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 8

9

Maximum allowable research credit if available. See instructions. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 9

10

Corporation’s own 15-year carryover credit from prior years . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 10

11

Corporation’s own unlimited credit from prior years. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 11

12

Corporation’s own credit generated in current year. . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12

13

Corporation’s own total research credit available for 2011 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 3 13

14

Amount of corporation’s credit used against its own excise . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14

15

Amount of corporation’s credit used by affiliates. See instructions . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15

16

Total of corporation’s credit used this year. Add lines 14 and 15 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 16

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3