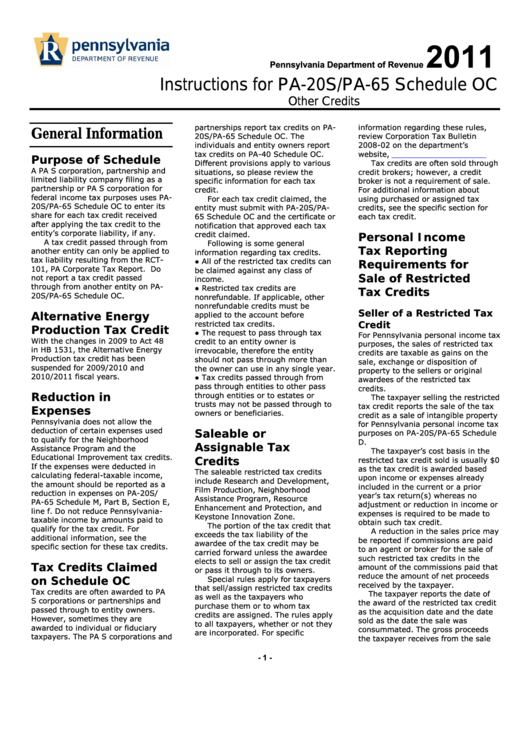

Instructions For Form Pa-20s/pa-65 - Schedule Oc - Other Credits - 2011

ADVERTISEMENT

2011

Pennsylvania Department of Revenue

Instructions for PA-20S/PA-65 Schedule OC

Other Credits

partnerships report tax credits on PA-

information regarding these rules,

General Information

20S/PA-65 Schedule OC. The

review Corporation Tax Bulletin

individuals and entity owners report

2008-02 on the department’s

tax credits on PA-40 Schedule OC.

website,

Purpose of Schedule

Different provisions apply to various

Tax credits are often sold through

A PA S corporation, partnership and

situations, so please review the

credit brokers; however, a credit

limited liability company filing as a

specific information for each tax

broker is not a requirement of sale.

partnership or PA S corporation for

credit.

For additional information about

federal income tax purposes uses PA-

For each tax credit claimed, the

using purchased or assigned tax

20S/PA-65 Schedule OC to enter its

entity must submit with PA-20S/PA-

credits, see the specific section for

share for each tax credit received

65 Schedule OC and the certificate or

each tax credit.

after applying the tax credit to the

notification that approved each tax

entity’s corporate liability, if any.

credit claimed.

Personal Income

A tax credit passed through from

Following is some general

Tax Reporting

another entity can only be applied to

information regarding tax credits.

tax liability resulting from the RCT-

● All of the restricted tax credits can

Requirements for

101, PA Corporate Tax Report. Do

be claimed against any class of

Sale of Restricted

not report a tax credit passed

income.

through from another entity on PA-

● Restricted tax credits are

Tax Credits

20S/PA-65 Schedule OC.

nonrefundable. If applicable, other

nonrefundable credits must be

Seller of a Restricted Tax

Alternative Energy

applied to the account before

restricted tax credits.

Credit

Production Tax Credit

● The request to pass through tax

For Pennsylvania personal income tax

With the changes in 2009 to Act 48

credit to an entity owner is

purposes, the sales of restricted tax

in HB 1531, the Alternative Energy

irrevocable, therefore the entity

credits are taxable as gains on the

Production tax credit has been

should not pass through more than

sale, exchange or disposition of

suspended for 2009/2010 and

the owner can use in any single year.

property to the sellers or original

2010/2011 fiscal years.

● Tax credits passed through from

awardees of the restricted tax

pass through entities to other pass

credits.

Reduction in

through entities or to estates or

The taxpayer selling the restricted

trusts may not be passed through to

tax credit reports the sale of the tax

Expenses

owners or beneficiaries.

credit as a sale of intangible property

Pennsylvania does not allow the

for Pennsylvania personal income tax

deduction of certain expenses used

Saleable or

purposes on PA-20S/PA-65 Schedule

to qualify for the Neighborhood

D.

Assignable Tax

Assistance Program and the

The taxpayer’s cost basis in the

Educational Improvement tax credits.

Credits

restricted tax credit sold is usually $0

If the expenses were deducted in

as the tax credit is awarded based

The saleable restricted tax credits

calculating federal-taxable income,

upon income or expenses already

include Research and Development,

the amount should be reported as a

included in the current or a prior

Film Production, Neighborhood

reduction in expenses on PA-20S/

year’s tax return(s) whereas no

Assistance Program, Resource

PA-65 Schedule M, Part B, Section E,

adjustment or reduction in income or

Enhancement and Protection, and

line f. Do not reduce Pennsylvania-

expenses is required to be made to

Keystone Innovation Zone.

taxable income by amounts paid to

obtain such tax credit.

The portion of the tax credit that

qualify for the tax credit. For

A reduction in the sales price may

exceeds the tax liability of the

additional information, see the

be reported if commissions are paid

awardee of the tax credit may be

specific section for these tax credits.

to an agent or broker for the sale of

carried forward unless the awardee

such restricted tax credits in the

elects to sell or assign the tax credit

Tax Credits Claimed

amount of the commissions paid that

or pass it through to its owners.

reduce the amount of net proceeds

on Schedule OC

Special rules apply for taxpayers

received by the taxpayer.

that sell/assign restricted tax credits

Tax credits are often awarded to PA

The taxpayer reports the date of

as well as the taxpayers who

S corporations or partnerships and

the award of the restricted tax credit

purchase them or to whom tax

passed through to entity owners.

as the acquisition date and the date

credits are assigned. The rules apply

However, sometimes they are

sold as the date the sale was

to all taxpayers, whether or not they

awarded to individual or fiduciary

consummated. The gross proceeds

are incorporated. For specific

taxpayers. The PA S corporations and

the taxpayer receives from the sale

- 1 -

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8