Form 706 (Rev. 8-2013)

Decedent’s social security number

Estate of:

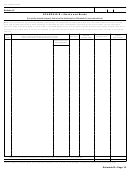

SCHEDULE O—Charitable, Public, and Similar Gifts and Bequests

Note. If the value of the gross estate, together with the amount of adjusted taxable gifts, is less than the basic exclusion amount and the

Form 706 is being filed solely to elect portability of the DSUE amount, consideration should be given as to whether you are required to

report the value of assets eligible for the marital or charitable deduction on this schedule. See the instructions and Reg. section 20.2010-2T

(a)(7)(ii) for more information. If you are not required to report the value of an asset, identify the property but make no entry in the last

column.

Yes

No

1 a If the transfer was made by will, has any action been instituted to contest or have interpreted any of its provisions

affecting the charitable deductions claimed in this schedule? .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

If ‘‘Yes,’’ full details must be submitted with this schedule.

b According to the information and belief of the person or persons filing this return, is any such action planned?

.

If ‘‘Yes,’’ full details must be submitted with this schedule.

2

Did any property pass to charity as the result of a qualified disclaimer?

.

.

.

.

.

.

.

.

.

.

.

.

.

.

If ‘‘Yes,’’ attach a copy of the written disclaimer required by section 2518(b).

Item

Name and address of beneficiary

Amount

Character of institution

number

1

Total from continuation schedules (or additional statements) attached to this schedule .

.

.

.

.

.

.

.

.

.

3

3

Total

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4a Federal estate tax payable out of property interests listed above .

.

.

.

.

4a

b Other death taxes payable out of property interests listed above .

.

.

.

.

4b

c Federal and state GST taxes payable out of property interests listed above .

4c

d Add items 4a, 4b, and 4c

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

4d

5

Net value of property interests listed above (subtract 4d from 3). Also enter on Part 5—Recapitulation,

5

page 3, at item 22 .

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

.

(If more space is needed, attach the continuation schedule from the end of this package or additional statements of the same size.)

Schedule O—Page 21

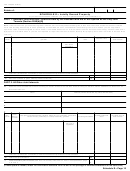

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27 28

28 29

29 30

30 31

31