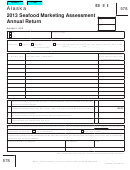

Taxpayer name

680

Federal EIN or SSN

Note: complete Schedules 1 and 2, as needed, and transfer the totals to Part 1, Part 2 and Part 3 below.

Part 1: Established

Amount

1. Total unprocessed value from Schedules 1E (Established)

2. Total unprocessed value from Schedules 2E (Established)

3. Total value (add lines 1 and 2)

4. Tax. Multiply line 3 by 3% (.03). Enter here and on Page 1, line 1a

Part 2: Developing

Amount

1. Total unprocessed value from Schedules 1D (Developing)

2. Total unprocessed value from Schedules 2D (Developing)

3. Total value (add lines 1 and 2)

4. Tax. Multiply line 3 by 1% (.01). Enter here and on Page 1, line 1b

Part 3: Alaska Seafood Marketing Assessment

Amount

1. Enter the total value of fishery resources from Part 1, line 3 and Part 2, line 3

2. Assessment. If the value on line 1 is greater than or equal to $50,000, multiply the value on line 1 by 0.5% (.005)

.

and enter the result here and on Page 1, line 4

Enter Zero here and on Page 1, line 4 if the value on line 1 is less than $50,000

Payment Record

Estimated payments

EFT or check number

Date

Amount

1. Overpayment credit from prior year

2. First quarter due April 1

3. Second quarter due June 30

4. Third quarter due September 30

5. Fourth quarter due December 31

6. Final payment due March 31 of year

following tax year

7. Other payment

8. Amended returns only. Tax payment(s) made with original and previously filed amended returns

9. Total payments. Add lines 1 through 8 and enter here and on Page 1, line 7

680

0405-680 Rev 12/19/13 - page 2

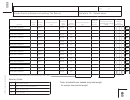

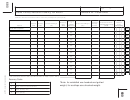

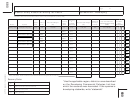

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18