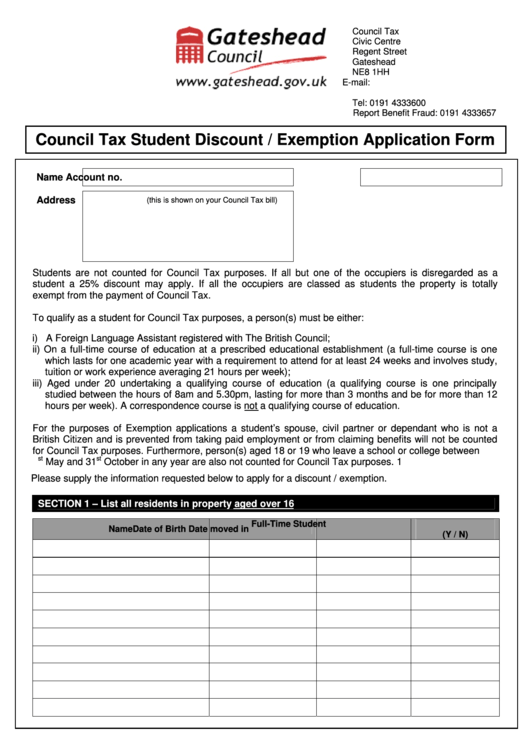

Council Tax Student Discount / Exemption Application Form - Gateshead Council,united Kingdom

ADVERTISEMENT

Council Tax

Civic Centre

Regent Street

Gateshead

NE8 1HH

E-mail: counciltax@gateshead.gov.uk

Tel: 0191 4333600

Report Benefit Fraud: 0191 4333657

Council Tax Student Discount / Exemption Application Form

Name

Account no.

Address

(this is shown on your Council Tax bill)

Students are not counted for Council Tax purposes. If all but one of the occupiers is disregarded as a

student a 25% discount may apply. If all the occupiers are classed as students the property is totally

exempt from the payment of Council Tax.

To qualify as a student for Council Tax purposes, a person(s) must be either:

i) A Foreign Language Assistant registered with The British Council;

ii) On a full-time course of education at a prescribed educational establishment (a full-time course is one

which lasts for one academic year with a requirement to attend for at least 24 weeks and involves study,

tuition or work experience averaging 21 hours per week);

iii) Aged under 20 undertaking a qualifying course of education (a qualifying course is one principally

studied between the hours of 8am and 5.30pm, lasting for more than 3 months and be for more than 12

hours per week). A correspondence course is not a qualifying course of education.

For the purposes of Exemption applications a student’s spouse, civil partner or dependant who is not a

British Citizen and is prevented from taking paid employment or from claiming benefits will not be counted

for Council Tax purposes. Furthermore, person(s) aged 18 or 19 who leave a school or college between

st

st

1

May and 31

October in any year are also not counted for Council Tax purposes.

Please supply the information requested below to apply for a discount / exemption.

SECTION 1 – List all residents in property aged over 16

Full-Time Student

Name

Date of Birth

Date moved in

(Y / N)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2