LINE 12. The total amount from each Schedule 85A, column H,

Save time, eliminate errors, and reduce paperwork!

line 92 PLUS all applicable surcharges.

File online at @

LINE 13. If this return is filed late, enter ten percent (10%) of the

WHO MUST FILE. Every Kansas based motor carrier issued a

amount on line 12, or $50.00, whichever is greater.

permit under the International Fuel Tax Agreement is required to

LINE 16. A balance due or credit resulting from a partial payment,

file an International Fuel Tax Agreement (IFTA) Tax Return, Form

mathematical or clerical errors, penalty, or interest relating to prior

MF-85, each quarter. Go to for jurisdiction’s

returns will be entered in this space by the Kansas Department of

current tax rates, tax rate footnotes, exemptions, and contact

Revenue. If the amount entered has been satisfied by a previous

information.

remittance or refund, it should be disregarded when computing the

U.S./Metric Measurements

amount to remit on line 17.

One Liter = 0.2642 Gallons

One Gallon = 3.785 Liters

LINE 17.

If the amount on line 17 is a balance due, attach

One Mile = 1.6093 Kilometers

One Kilometer = 0.62137 Miles

payment. If the amount on line 17 is a credit balance greater than

WHEN AND WHERE TO FILE. This return, properly signed

$10.00, you may check the "REFUND REQUESTED" block, and a

and accompanied by a check or money order payable to the Kansas

refund will be issued to you. If the block is not checked, the credit

Department of Revenue, will be considered timely filed if

balance will be applied to your next return. Credit balances cannot

postmarked on or before the last day of the month following the

be carried for more than eight quarters (two years) from the date

A return is required for each

quarter covered by the return.

established.

Tax returns computed incorrectly will be assessed

quarter even though no fuel tax is due.

Mail the return to:

penalty and interest.

Department of Revenue, Customer Relations, 915 SW Harrison St.,

SIGNATURES. This return must be signed by the owner, partner,

Topeka, KS 66625-8000

or corporate officer. If the taxpayer authorized another person to

QUALIFIED MOTOR VEHICLES. All vehicles in the licensee's

sign this return, there must be a power of attorney on file with the

fleet bearing a Kansas IFTA decal must be included on this return.

Kansas Department of Revenue.

Any person who is paid for

Qualifying vehicle means a motor vehicle (1) having two axles and

preparing a taxpayer's return must also sign the return as preparer.

a gross vehicle weight or registered gross vehicle weight exceeding

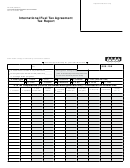

INSTRUCTIONS FOR KANSAS SCHEDULE 85A IFTA

26,000 lbs. or 11,797 kgs., or; (2) having three or more axles

FUEL TAX COMPUTATION

regardless of weight; (3) is used in combination when the weight of

such combination exceeds 26,000 lbs. or 11,797 kgs. gross vehicle

ROUNDING. All miles and gallons must be rounded to whole

weight.

numbers. For example, 525.5 must be shown as 526, and 525.4

must be shown as 525. NOTE: Have your calculator decimal

PREIDENTIFIED RETURNS. This return is to be used only by

selector set to the fullest mark.

the motor carrier whose name is printed on it. If you have not

received a return for a reporting period, request a duplicate from the

COLUMN B. Enter the total miles traveled in each jurisdiction for

department. If the business name, location, or mailing address is

each fuel type listed. Some jurisdictions do not require all fuel

not correct, mark through the incorrect information and plainly print

types to be reported. Do not add any jurisdictions or fuel types to

the correct information.

the list. "Total miles traveled in all jurisdictions" cover page,

column B must match the total shown on line 92, column B of

AMENDED RETURNS.

If it becomes necessary to correct a

schedule 85A for each fuel type!

previously filed return, please make a copy of the original paper

return filed, mark the box at the top that indicates it is an amended

COLUMN C. All miles traveled in Kansas are taxable miles, but

return, and make the necessary changes next to the incorrect

some off-highway miles in other jurisdictions are not taxable.

figures.

An explanation of the changes must accompany the

COLUMN D. Divide the amount in Column C by the average

amended return. (If filed on-line contact our office for further

miles per gallon from Column D on Form MF-85 for each fuel type.

instructions.)

Round this to a whole figure-no decimals.

VERIFICATION AND AUDIT.

The records required to

COLUMN E. Enter gallons purchased during this reporting period

substantiate this return must be retained and be available for at least

on which fuel taxes have been paid. Purchases must be supported

four years from the due date of the return or the date filed,

"Total

by invoices from the vendor retained in your records.

whichever is later. Records which are required to be kept are listed

gallons purchased in all jurisdictions" cover page, column C

in the IFTA Informational Manual provided by this department.

must match the total shown on line 92, column E of Schedule

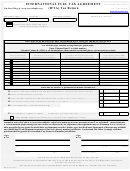

INSTRUCTIONS FOR KANSAS FORM 85

85A for each fuel type!

IFTA FUEL TAX RETURN

COLUMN F. Subtract the amount in Column E from the amount

LINES 1 THROUGH 11. Indicate the types of fuel used. For

in Column D (Col. D minus Col. E). If E is greater than D, enter

each type of fuel used, indicate the total miles traveled in all

the credit figures in brackets, i.e. <00>.

jurisdictions (States of the United States, District of Columbia, or

COLUMN H. Multiply the amount in Column F times the amount

Provinces or Territories of Canada) in Column B. Next enter the

total fuel purchased and dispensed into IFTA qualified motor

in Column G (Col. F x Col. G). Enter this amount in dollars and

vehicles in all jurisdictions in Column C. Then divide column B by

cents. Enter credit amounts in brackets, i.e. <$00.00>.

Column C to compute the average miles per gallon (AMG).

COLUMN I.

NOTE:

Have your calculator set to the fullest mark.

If this return is filed late, interest is due each

This

jurisdiction where there is tax due. Multiply Column H amount by

calculation must be carried to six places and then round to two

the monthly rate identified in the Column I heading.

decimal places. For example, 5.255000 should be shown as 5.26

and 5.254999 should be shown as 5.25. NOTE: Schedule 85A-

COLUMN J. Total of Columns H and I. Enter credit amounts in

IFTA Fuel Tax Computation must be completed for each fuel type.

brackets, i.e. <$00.00>.

1

1 2

2