Form It 511 - Individual Income Tax 500 And 500ez Forms And General Instructions - 2012 Page 19

ADVERTISEMENT

INSTRUCTIONS FOR PART-YEAR RESIDENTS AND NONRESIDENTS

Part-year residents and nonresidents who work in Georgia or receive income from Georgia sources are required to file Georgia Form

500 and complete Schedule 3 to calculate Georgia taxable income. A married part-year resident or nonresident with income earned in

Georgia whose spouse is a nonresident with no Georgia source income may file either a separate return claiming himself/herself only,

or a joint return claiming total allowable deductions. If one spouse is a resident and one is a part-year resident or nonresident, enter 3

in the residency status box and complete Form 500, Schedule 3 to calculate Georgia taxable income.

Part-year Residents. If you are a legal resident of Georgia for only a portion of the tax year and are required to file a Federal income tax

return, you are required to file a Georgia income tax return.

Part-year residents who claim a credit for taxes paid to another state for income earned while a resident must include a copy of the

individual income tax return filed with that state(s) with a copy of their Georgia return. Otherwise the credit will not be allowed.

Nonresidents. Nonresidents who work in Georgia or receive income from Georgia sources and are required to file a Federal return

are required to file a Georgia income tax return.

Legal residents of other states are not required to file a Georgia tax return if their only activity for financial gain or profit in Georgia

consists of performing services for an employer as an employee where the wages for such services does not exceed the lesser of five

percent of the income received from performing services in all places during the taxable year or $5,000.

A nonresident, who receives deferred compensation or income from the exercise of stock options that were earned in Georgia in a

prior year is required to pay tax on the income, but only if the prior year’s income exceeds the lesser of: 1) 5 percent of the income

received by the person in all places during the current taxable year; or 2) $5,000. However, the income is not taxed if federal law

prohibits the state from taxing it. Federal law prohibits state taxation of some types of retirement income including pensions as well

as income received from nonqualified deferred compensation plans if the income is paid out over the life expectancy of the person or

at least 10 years. See Regulation 560-7-4-.05 for more information.

Adjusted Gross Income. The percentage on Schedule 3, Line 9 is zero if Georgia adjusted gross income (AGI) is zero or negative. If

the adjusted Federal AGI is zero or negative, the Line 9 percentage is 100%. The percentage is also considered to be 100% if both

adjusted Federal and Georgia AGI are zero or negative. In this case, the taxpayer is entitled to the full exemption amount and deductions.

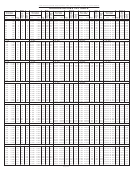

Instructions for Completing Schedule 3

(See example on page 18)

LINES 1 - 4, Column A: List your Federal income.

LINES 1 - 4, Column B: List your income not taxable to Georgia.

LINES 1 - 4, Column C: List your Georgia taxable income.

LINE 5, Columns A, B, and C: Enter the total of Lines 1- 4 in Columns A, B, and C respectively.

LINES 6 - 7, Column A: List adjustments from your federal return on Line 6; list adjustments allowed by Georgia law on Line 7. See

the Line 9 instructions on pages 11 and 12 for adjustments allowed by Georgia law.

LINES 6 - 7, Column B: List adjustments that do not apply to Georgia residency or do not apply because of taxable income earned as

a nonresident.

LINES 6 - 7, Column C: List adjustments from the Federal return that apply to Georgia on Line 6; list Georgia adjustments on Line 7.

See the Line 9 instructions on pages 11 and 12 for adjustments allowed by Georgia law.

LINES 8 A, B and C: Subtract Line 6 from Line 5 in each column; and add or subtract Line 7 from Line 5 in each column. Enter the total

for each column on Line 8 A, B, and C respectively.

LINE 9: Divide Line 8, Column C by Line 8, Column A to calculate the ratio of Georgia income to total income.

LINE 10: If itemizing, enter the amount from Federal Schedule A reduced by income taxes paid to other states or expense for the

production of non-Georgia income. Enclose a copy of Federal Schedule A with your Georgia income tax return. If using the standard

deduction, enter the amount for your filing status as indicated below.

Single/Head of Household:

$2,300

Married Filing Joint:

$3,000

Married Filing Separate:

$1,500

Additional Deduction for Blind and/or 65 or older:

$1,300

LINES 11a-c: Multiply Form 500, Line 6c by $2,700 and enter the total on Line 11a. Multiply Form 500, Line 7a by $3,000 and enter the

total on Line 11b. Enter the total of Lines 11a plus 11b on Line 11c.

LINE 12: Add Lines 10 and 11c.

LINE 13: Multiply Line 12 by the percentage on Line 9.

LINE 14: Subtract Line 13 from Line 8, Column C. This is your Georgia taxable income. Enter here and on Form 500, Line 15. Use

the income tax table on pages 20-22 to determine your tax and enter on Form 500, Line 16.

List states in which the income in Column B was earned and/or reported. Follow the instructions on page 13 to complete Lines 16

through 36 of Form 500. Enclose copies of applicable returns and schedules with your Georgia return.

Page 17

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27