Form It 511 - Individual Income Tax 500 And 500ez Forms And General Instructions - 2012 Page 20

ADVERTISEMENT

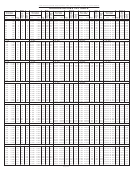

EXAMPLE FOR COMPLETING SCHEDULE 3

500

Basis for Example: A husband and wife are both part-year residents of Georgia who file a joint return.

Georgia Form

Their Federal adjusted gross income is $52,000 consisting of $48,000 in salary and $4,000 of interest.

Individual Income Tax Return

They have one child and adjustments to income totaling $2,500. They became Georgia residents on

Georgia Department of Revenue

April 1. Their Schedule 3 would be completed as follows:

2011

YOUR SOCIAL SECURITY NUMBER

9

9

9

8

8

8

7

7

7

6

6

6

5

5

5

4

4

4

3

3

3

2

2

2

1

1

1

9

9

8

8

7

7

6

6

5

5

4

4

3

3

2

2

1

1

Version 1

DO NOT USE LINES 9 THRU 14 OF PAGE 2, FORM 500

SCHEDULE 3 COMPUTATION OF GEORGIA TAXABLE INCOME FOR ONLY PART-YEAR

RESIDENTS AND NONRESIDENTS.

Income earned in another state as a Georgia resident is taxable but other state(s)

tax credit may apply. See Tax Booklet, Page 13, Line 17 and Page 15

FEDERAL INCOME AFTER GEORGIA ADJUSTMENT

INCOME NOT TAXABLE TO GEORGIA

GEORGIA INCOME

(COLUMN C)

(COLUMN A)

(COLUMN B)

1. WAGES, SALARIES, TIPS, etc

1. WAGES, SALARIES, TIPS, etc

1. WAGES, SALARIES, TIPS, etc

4 8 0 0 0

4 8 0 0 0

3

3

6

6

5

5

4

4

7

7

4 8 0 0 0

4 8 0 0 0

4 8 0 0 0

1

1

1

1

4 5

4 5

3

3

3

3

3

6

6

6

5

5

5

4

4

4

7

7

7

1

1

1

1

1

1

4 5

4 5

4 5

3

3

3

,

,

.

00

,

,

.

00

,

,

.

00

4,

2.

INTERESTS AND DIVIDENDS

2.

INTERESTS AND DIVIDENDS

2.

INTERESTS AND DIVIDENDS

4 0 0 0

4 0 0 0

4 0 0 0

4 0 0 0

4 0 0 0

9 5

9 5

4

4

3

3

0

0

4 6

4 6

9 5

9 5

9 5

4

4

4

3

3

3

0

0

0

4 6

4 6

4 6

,

,

.

00

,

,

.

00

,

,

.

00

3.

BUSINESS INCOME OR (LOSS)

3. BUSINESS INCOME OR (LOSS)

3. BUSINESS INCOME OR (LOSS)

,

,

.

00

,

,

.

00

,

,

.

00

4.

OTHER INCOME OR (LOSS)

4. OTHER INCOME OR (LOSS)

4. OTHER INCOME OR (LOSS)

,

,

.

00

,

,

.

00

,

,

.

00

5. TOTAL INCOME: TOTAL LINES 1 THRU 4

5. TOTAL INCOME: TOTAL LINES 1 THRU 4

5. TOTAL INCOME: TOTAL LINES 1 THRU 4

1

1

2 4

2 4

0 7

0 7

3 9

3 9

5 9 3

5 9 3

5 2 0 0 0

5 2 0 0 0

1

1

1

2 4

2 4

2 4

0 7

0 7

0 7

3 9

3 9

3 9

5 9 3

5 9 3

5 9 3

5 2 0 0 0

5 2 0 0 0

5 2 0 0 0

00

00

00

,

,

.

,

,

.

,

,

.

6. TOTAL ADJUSTMENTS FROM FORM 1040

6. TOTAL ADJUSTMENTS FROM FORM 1040

6. TOTAL ADJUSTMENTS FROM FORM 1040

- 2 0 0 0

- 2 0 0 0

- - - - -

2 0 0 0

2 0 0 0

- 2 0 0 0

- 2 0 0 0

- 2 0 0 0

2 0 0 0

2 0 0 0

2 0 0 0

,

,

.

00

,

,

.

00

,

,

.

00

7. TOTAL ADJUSTMENTS FROM FORM 500,

7. TOTAL ADJUSTMENTS FROM FORM 500,

7. TOTAL ADJUSTMENTS FROM FORM 500,

SCHEDULE 1, PAGE 4

SCHEDULE 1, PAGE 4

SCHEDULE 1, PAGE 4

- 5 0 0

- 5 0 0

- 5 0 0

- 5 0 0

- 5 0 0

-

-

-

-

-

5 0 0

5 0 0

5 0 0

5 0 0

5 0 0

,

,

.

00

,

,

.

00

,

,

.

00

8. ADJUSTED GROSS INCOME:

8. ADJUSTED GROSS INCOME:

8. ADJUSTED GROSS INCOME:

LINE 5 PLUS OR MINUS LINES 6 AND 7

LINE 5 PLUS OR MINUS LINES 6 AND 7

LINE 5 PLUS OR MINUS LINES 6 AND 7

4 9 5 0 0

4 9 5 0 0

1

1

1

1

1

0

0

0

0

0

4 0

4 0

4 0

4 0

4 0

7

7

7

7

7

3 9

3 9

3 9

3 9

3 9

0 9 3

0 9 3

0 9 3

0 9 3

0 9 3

4 9 5 0 0

4 9 5 0 0

4 9 5 0 0

00

00

00

,

,

.

,

,

.

,

,

.

7 8 9

7 8 9

7 8 9

7 8 9

7 8 9

8 8 8 8 8

.

% Not to exceed 100%

9.

RATIO: Divide Line 8, Column C by

Line 8, Column A. Enter percentage.............

9.

3 0 0 0

3 0 0 0

3 0 0 0

3 0 0 0

3 0 0 0

,

,

.

00

10. Itemized

or Standard Deduction X (See Tax Booklet, Page 17, Line 10)...

10.

11. Personal Exemption from Form 500, Page 2 (See Tax Booklet, Pg. 17, Line 11a-c)

5 4 0 0

5 4 0 0

5 4 0 0

5 4 0 0

5 4 0 0

2 2 2 2 2

,

,

.

00

11a. Number on Line 6c.

multiplied by $2,700...................................................

11a.

3

3

3

3

3

0 0 0

0 0 0

0 0 0

0 0 0

0 0 0

1 1 1 1 1

00

,

,

.

11b. Number on Line 7a.

multiplied by $3,000..................................................

11b.

8

8

8

4 0 0

4 0 0

4 0 0

8

8

4 0 0

4 0 0

00

,

,

.

11c. Add Lines 11a. and 11b. Enter total.......................................................................

11c.

1

1

1

1

1

1

4 0 0

4 0 0

4 0 0

1

1

1

1

4 0 0

4 0 0

,

,

.

00

Add Lines 10 and 11c.............................

12. Total Deductions and Exemptions:

12.

9

9

0 0 4

0 0 4

9

9

9

0 0 4

0 0 4

0 0 4

,

,

.

00

13. Multiply Line 12 by Ratio on Line 9 and enter result............................................

13.

14. Georgia Taxable Income: Subtract Line 13 from Line 8, Column C

3

3

0 0 8 9

0 0 8 9

3

3

3

0 0 8 9

0 0 8 9

0 0 8 9

00

,

,

.

Enter here and on Line 15, Page 2 of Form 500..................................................

14.

List the state(s) in which the income in Column B was earned and/or to which it was reported.

S o u t h

C a r o l i n a

1.

3.

2.

A l a b a m a

4.

Page 18

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21 22

22 23

23 24

24 25

25 26

26 27

27