Instructions For Supplement To Corporation Tax (Form Ct-1) - 2013

ADVERTISEMENT

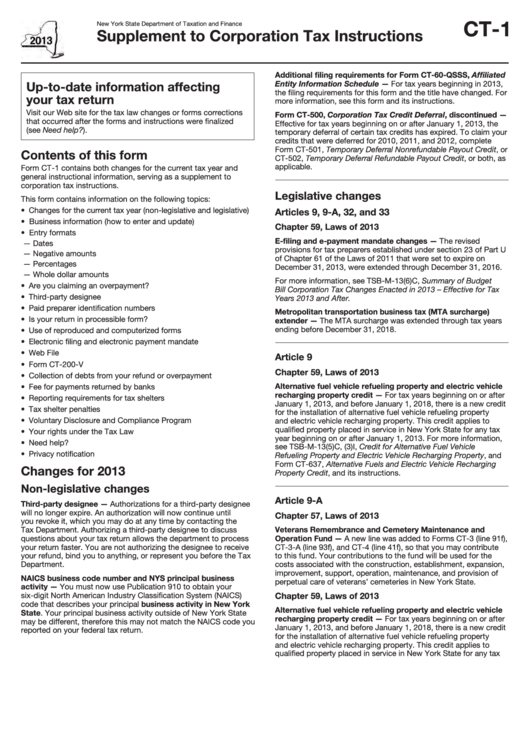

CT-1

New York State Department of Taxation and Finance

Supplement to Corporation Tax Instructions

Additional filing requirements for Form CT-60-QSSS, Affiliated

Up-to-date information affecting

Entity Information Schedule — For tax years beginning in 2013,

the filing requirements for this form and the title have changed. For

your tax return

more information, see this form and its instructions.

Visit our Web site for the tax law changes or forms corrections

Form CT-500, Corporation Tax Credit Deferral, discontinued —

that occurred after the forms and instructions were finalized

Effective for tax years beginning on or after January 1, 2013, the

(see Need help?).

temporary deferral of certain tax credits has expired. To claim your

credits that were deferred for 2010, 2011, and 2012, complete

Form CT-501, Temporary Deferral Nonrefundable Payout Credit, or

Contents of this form

CT-502, Temporary Deferral Refundable Payout Credit, or both, as

applicable.

Form CT-1 contains both changes for the current tax year and

general instructional information, serving as a supplement to

corporation tax instructions.

Legislative changes

This form contains information on the following topics:

• Changes for the current tax year (non-legislative and legislative)

Articles 9, 9-A, 32, and 33

• Business information (how to enter and update)

Chapter 59, Laws of 2013

• Entry formats

E-filing and e-payment mandate changes — The revised

— Dates

provisions for tax preparers established under section 23 of Part U

— Negative amounts

of Chapter 61 of the Laws of 2011 that were set to expire on

— Percentages

December 31, 2013, were extended through December 31, 2016.

— Whole dollar amounts

For more information, see TSB-M-13(6)C, Summary of Budget

• Are you claiming an overpayment?

Bill Corporation Tax Changes Enacted in 2013 – Effective for Tax

• Third-party designee

Years 2013 and After.

• Paid preparer identification numbers

Metropolitan transportation business tax (MTA surcharge)

• Is your return in processible form?

extender — The MTA surcharge was extended through tax years

ending before December 31, 2018.

• Use of reproduced and computerized forms

• Electronic filing and electronic payment mandate

• Web File

Article 9

• Form CT-200-V

Chapter 59, Laws of 2013

• Collection of debts from your refund or overpayment

Alternative fuel vehicle refueling property and electric vehicle

• Fee for payments returned by banks

recharging property credit — For tax years beginning on or after

• Reporting requirements for tax shelters

January 1, 2013, and before January 1, 2018, there is a new credit

• Tax shelter penalties

for the installation of alternative fuel vehicle refueling property

• Voluntary Disclosure and Compliance Program

and electric vehicle recharging property. This credit applies to

qualified property placed in service in New York State for any tax

• Your rights under the Tax Law

year beginning on or after January 1, 2013. For more information,

• Need help?

see TSB-M-13(5)C, (3)I, Credit for Alternative Fuel Vehicle

• Privacy notification

Refueling Property and Electric Vehicle Recharging Property, and

Form CT-637, Alternative Fuels and Electric Vehicle Recharging

Changes for 2013

Property Credit, and its instructions.

Non-legislative changes

Article 9-A

Third-party designee — Authorizations for a third-party designee

will no longer expire. An authorization will now continue until

Chapter 57, Laws of 2013

you revoke it, which you may do at any time by contacting the

Veterans Remembrance and Cemetery Maintenance and

Tax Department. Authorizing a third-party designee to discuss

questions about your tax return allows the department to process

Operation Fund — A new line was added to Forms CT-3 (line 91f),

your return faster. You are not authorizing the designee to receive

CT-3-A (line 93f), and CT-4 (line 41f), so that you may contribute

your refund, bind you to anything, or represent you before the Tax

to this fund. Your contributions to the fund will be used for the

Department.

costs associated with the construction, establishment, expansion,

improvement, support, operation, maintenance, and provision of

NAICS business code number and NYS principal business

perpetual care of veterans’ cemeteries in New York State.

activity — You must now use Publication 910 to obtain your

six-digit North American Industry Classification System (NAICS)

Chapter 59, Laws of 2013

code that describes your principal business activity in New York

Alternative fuel vehicle refueling property and electric vehicle

State. Your principal business activity outside of New York State

recharging property credit — For tax years beginning on or after

may be different, therefore this may not match the NAICS code you

January 1, 2013, and before January 1, 2018, there is a new credit

reported on your federal tax return.

for the installation of alternative fuel vehicle refueling property

and electric vehicle recharging property. This credit applies to

qualified property placed in service in New York State for any tax

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5