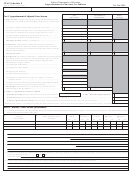

Tax Year

Schedule AP 2013

Apportionment of Income for

* 1 5 5 7 1 3 0 1 0 1 0 0 0 0 *

Corporations and Partnerships

Name of entity as shown on your Oregon return

FEIN

BIN

Describe the nature and location(s) of your Oregon business activities:

(Do not enter an amount of less than zero)

Schedule AP-1—Apportionment information

(b)

(a)

Everywhere

Oregon

Property/real estate income and interest factor

1. Inventories .......................................................................................................... 1

2. Buildings and other depreciable assets .............................................................. 2

3. Land .................................................................................................................... 3

4. Other assets ........................................................................................................ 4

5. Minus: Construction in progress ......................................................................... 5

6. Rented property (capitalize at 8 times the rental paid) ....................................... 6

7. Net income from real property (insurance only) ................................................. 7

8. Interest received on loans secured by real property (insurance only) ................. 8

•

•

9. Total property or real estate income and interest............................................... 9

Payroll factor (wage and commission)

10. Compensation of officers ..................................................................................10

11. Other wages, salaries, and commissions .........................................................11

•

•

12. Total wages and compensation .......................................................................12

Sales factor

13. Shipped from outside Oregon ...........................................................................13

14. Shipped from inside Oregon .............................................................................14

•

15. Shipped from Oregon to the United States government ..................................15

•

16. Shipped from Oregon to purchasers where corporation is not taxable ............16

17. Other business receipts ....................................................................................17

18. Direct premiums (insurance only) ......................................................................18

19. Annuity considerations (insurance only) ............................................................19

20. Finance and service charge (insurance only) ....................................................20

•

•

21. Total sales ........................................................................................................21

_ _ _ . _ _ _ _

•

%

22. Oregon apportionment percentage (Enter the amount from the worksheet). ............................................... 22

Schedule AP-2—Taxable income computation

1. Income .........................................................................................................................................................................1

•

2. Subtract: Net nonbusiness income included in line 1. Attach schedule ...................................................................2

•

3. Subtract: Gains from prior year installment sales included in line 1. Attach schedule .............................................3

4. Total net income subject to apportionment ...............................................................................................................4

×

%

5. Oregon apportionment percentage (from Schedule AP-1, line 22) ..............................................................................5

6. Income apportioned to Oregon (line 4 times line 5) .....................................................................................................6

•

7. Add: Net nonbusiness income allocated entirely to Oregon. Attach schedule .........................................................7

•

8. Add: Gain from prior year installment sales apportioned to Oregon. Attach schedule ............................................8

9. Total of lines 6, 7, and 8 ...............................................................................................................................................9

•

10. (a) Oregon apportioned net loss from prior years. Attach schedule ..................... 10a

•

(b) Net capital loss from other years. Attach schedule ......................................... 10b

•

Total loss (line 10a plus line 10b) .............................................................................................................................. 10

11. Oregon taxable income (line 9 minus line 10) .......................................................................................................... 11

150-102-171 Schedule AP (Rev. 10-13)

1

1 2

2 3

3 4

4