GENERAL INSTRUCTIONS

Taxpayers who have questions and problems which are not covered

WHEN TO FILE: Each person responsible for the payment of

in these instructions may obtain assistance by writing to the Taxation

taxes levied in Section 149.160, RSMo shall file a return and remit

Division, Excise Tax, P.O. Box 3320, Jefferson City, MO 65105-

amounts owed monthly to the Director of Revenue on or before the

3320, telephone (573) 751-5772 or you can e-mail excise@dor.

fifteenth day of the month following the first sale within the state.

mo.gov.

“NO SALES” RETURNS REQUIRED: Every person with an Annual

You may also access the Department’s web site at

Retailer’s Other Tobacco Products License is required to file a return

to obtain this

on a monthly basis even though no purchases were made during a

form.

previous month.

WHO MUST FILE: Any retailer who purchases other tobacco

products directly from a manufacturer or non-licensed wholesaler.

OTP includes: chewing tobacco (snuff), loose-leaf tobacco (roll-your-own), cigars, cigarette papers, cigarette tubes, blunt wraps, filtered tips, and

anything that is a consumable product that is not an actual cigarette. The tobacco tax is also due on all free goods, promotional items, samples, and

discounted items.

Note: All applicable schedules should be completed first.

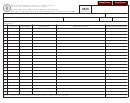

INSTRUCTIONS FOR COMPLETING FORM 4341

Line 1:

NOTE: FORM 4343, OTHER TOBACCO PRODUCTS

Line 7:

Any person responsible for the tax imposed in Section

(OTP) RECEIPTS MUST BE COMPLETED FIRST

149.160, RSMo who fails to pay such tax within the time

and manner required by law, shall pay, as part of the tax

Enter the invoice amount, before discounts and/or deals,

imposed, a penalty equal to 25% of the tax liability. If any

of other tobacco products received from unlicensed out-

amount of Line 6 was remitted (U.S. Postmarked) after

of-state suppliers. Attach Form 4343, OTP Receipts

the date prescribed, calculate 25% and enter the result on

Schedule.

Line 7.

Line 2A: NOTE: SCHEDULE A (FORM 4795) MUST BE

Line 8:

Enter the total of Line 6 plus Line 7 to arrive at your total

COMPLETED FIRST

Enter the total manufacturer’s

tax due.

invoice price (before discounts and/or deals) for all sales

made to person outside the state of Missouri.

Line 9:

Calculate interest due on any amount that was remitted

(postmarked by the United States Post Office) after the

Line 2B:

Enter the total manufacturer’s invoice price (before

date prescribed. Multiply the amount on Line 8 times the

discounts and/or deals) of all tobacco products (other

annual interest rate. Divide this number by 365 (366 for

than cigarettes) that were returned to the manufacturer.

leap years) and multiply the result by the number of days

A copy of the manufacturer’s refund/credit memo must be

late from the original due date of the return through the

attached to substantiate this deduction. Failure to attach

postmark date of payment. The annual interest rate is

such refund/credit memo may result in the disallowance

subject to change each year. You may access the

of such deduction.

annual interest rate on the Department’s web site at:

Line 2:

Enter the total of Line 2A and Line 2B to arrive at your

total exemptions.

Line 10:

Enter any tax overpayment credit carryover from

previously filed monthly report(s). You must attach a copy

Line 3:

Subtract Line 2 from Line 1 to arrive at your total amount

of the credit letter issued by the Department of Revenue

subject to tax.

which indicates that you have overpaid in a previous

month. Failure to attach the credit letter issued by the

Line 4:

Multiply Line 3 by 10% (.10) to arrive at the amount of tax

Department may result in disallowance of or adjustment

due.

to Line 22.

Line 5:

Multiply Line 4 by 2% (.02) to arrive at your timely remit-

Line 11:

Enter on Line 11 the total of Line 8 plus Line 9 less Line

tance deduction allowed. The discount will be forfeited if

10. If the total results in credit due, you will be sent a

not remitted on time. (The return must be deposited in the

“Letter of Credit” which may be used at Line 10 of your

United States Mail [U.S. Postmark] on or before the last

next filed monthly report. IF THE TOTAL RESULTS IN

date prescribed. If the last date prescribed is a Saturday,

A BALANCE DUE, FULL PAYMENT MUST BE MADE

a Sunday or a legal holiday in this state, it shall be consid-

WITH THE REPORT

ered timely if it is deposited in the United States Mail [U.S.

Postmark] on the next succeeding day which is not a

SIGN AND DATE RETURN: This return must be signed

Saturday, Sunday, or legal holiday.

by the owner, partner or by the taxpayer’s authorized

agent. Mail to: Taxation Division, Excise Tax, P.O. Box

Line 6:

Enter the total of Line 4 less Line 5 to arrive at your total

3320, Jefferson City, MO 65105-3320

tax due.

DOR-4341 (09-2011)

1

1 2

2