Instructions For Form 850 - Idaho Sales And Use Tax

ADVERTISEMENT

EIN00004

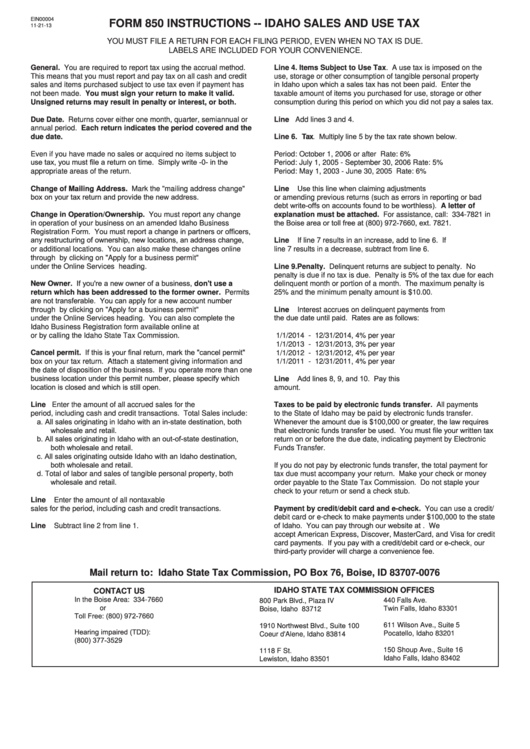

FORM 850 INSTRUCTIONS -- IDAHO SALES AND USE TAX

11-21-13

YOU MUST FILE A RETURN FOR EACH FILING PERIOD, EVEN WHEN NO TAX IS DUE.

LABELS ARE INCLUDED FOR YOUR CONVENIENCE.

General. You are required to report tax using the accrual method.

Line 4. Items Subject to Use Tax. A use tax is imposed on the

This means that you must report and pay tax on all cash and credit

use, storage or other consumption of tangible personal property

in Idaho upon which a sales tax has not been paid. Enter the

sales and items purchased subject to use tax even if payment has

not been made. You must sign your return to make it valid.

taxable amount of items you purchased for use, storage or other

consumption during this period on which you did not pay a sales tax.

Unsigned returns may result in penalty or interest, or both.

Due Date. Returns cover either one month, quarter, semiannual or

Line 5. Total Taxable. Add lines 3 and 4.

annual period. Each return indicates the period covered and the

Line 6. Tax. Multiply line 5 by the tax rate shown below.

due date.

Even if you have made no sales or acquired no items subject to

Period: October 1, 2006 or after

Rate: 6%

use tax, you must file a return on time. Simply write -0- in the

Period: July 1, 2005 - September 30, 2006

Rate: 5%

appropriate areas of the return.

Period: May 1, 2003 - June 30, 2005

Rate: 6%

Line 7. Adjustments. Use this line when claiming adjustments

Change of Mailing Address. Mark the "mailing address change"

box on your tax return and provide the new address.

or amending previous returns (such as errors in reporting or bad

debt write-offs on accounts found to be worthless). A letter of

Change in Operation/Ownership. You must report any change

explanation must be attached. For assistance, call: 334-7821 in

the Boise area or toll free at (800) 972-7660, ext. 7821.

in operation of your business on an amended Idaho Business

Registration Form. You must report a change in partners or officers,

any restructuring of ownership, new locations, an address change,

Line 8. Tax Due. If line 7 results in an increase, add to line 6. If

or additional locations. You can also make these changes online

line 7 results in a decrease, subtract from line 6.

through tax.idaho.gov by clicking on "Apply for a business permit"

under the Online Services heading.

Line 9. Penalty. Delinquent returns are subject to penalty. No

penalty is due if no tax is due. Penalty is 5% of the tax due for each

New Owner. If you're a new owner of a business, don't use a

delinquent month or portion of a month. The maximum penalty is

return which has been addressed to the former owner. Permits

25% and the minimum penalty amount is $10.00.

are not transferable. You can apply for a new account number

through tax.idaho.gov by clicking on "Apply for a business permit"

Line 10. Interest. Interest accrues on delinquent payments from

the due date until paid. Rates are as follows:

under the Online Services heading. You can also complete the

Idaho Business Registration form available online at tax.idaho.gov

or by calling the Idaho State Tax Commission.

1/1/2014 - 12/31/2014, 4% per year

1/1/2013 - 12/31/2013, 3% per year

Cancel permit. If this is your final return, mark the "cancel permit"

1/1/2012 - 12/31/2012, 4% per year

box on your tax return. Attach a statement giving information and

1/1/2011 - 12/31/2011, 4% per year

the date of disposition of the business. If you operate more than one

business location under this permit number, please specify which

Line 11. Total due this period. Add lines 8, 9, and 10. Pay this

location is closed and which is still open.

amount.

Line 1. Total Sales. Enter the amount of all accrued sales for the

Taxes to be paid by electronic funds transfer. All payments

period, including cash and credit transactions. Total Sales include:

to the State of Idaho may be paid by electronic funds transfer.

Whenever the amount due is $100,000 or greater, the law requires

a. All sales originating in Idaho with an in-state destination, both

wholesale and retail.

that electronic funds transfer be used. You must file your written tax

b. All sales originating in Idaho with an out-of-state destination,

return on or before the due date, indicating payment by Electronic

both wholesale and retail.

Funds Transfer.

c. All sales originating outside Idaho with an Idaho destination,

both wholesale and retail.

If you do not pay by electronic funds transfer, the total payment for

d. Total of labor and sales of tangible personal property, both

tax due must accompany your return. Make your check or money

wholesale and retail.

order payable to the State Tax Commission. Do not staple your

check to your return or send a check stub.

Line 2. Nontaxable Sales. Enter the amount of all nontaxable

sales for the period, including cash and credit transactions.

Payment by credit/debit card and e-check. You can use a credit/

debit card or e-check to make payments under $100,000 to the state

of Idaho. You can pay through our website at tax.idaho.gov. We

Line 3. Net Taxable Sales. Subtract line 2 from line 1.

accept American Express, Discover, MasterCard, and Visa for credit

card payments. If you pay with a credit/debit card or e-check, our

third-party provider will charge a convenience fee.

Mail return to: Idaho State Tax Commission, PO Box 76, Boise, ID 83707-0076

IDAHO STATE TAX COMMISSION OFFICES

CONTACT US

In the Boise Area: 334-7660

440 Falls Ave.

800 Park Blvd., Plaza IV

Twin Falls, Idaho 83301

or

Boise, Idaho 83712

Toll Free: (800) 972-7660

1910 Northwest Blvd., Suite 100

611 Wilson Ave., Suite 5

Hearing impaired (TDD):

Pocatello, Idaho 83201

Coeur d'Alene, Idaho 83814

(800) 377-3529

150 Shoup Ave., Suite 16

1118 F St.

Lewiston, Idaho 83501

Idaho Falls, Idaho 83402

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1