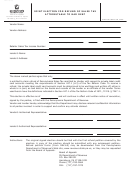

Form St-55 - Joint Election Between Vendor And Lender To Designate Entitlement To Claim Sales Tax Bad Debt Refund Or Credit Page 2

ADVERTISEMENT

Page 2 of 2 ST-55 (9/10)

7. Amendment or revocation of a previous election and consent to new election. If this election is an amendment or revocation of a

previously filed election, enter the information for the party previously designated to claim the bad debt credits or refunds related to the

subject accounts. The authorized representative of this party must sign in the Consent to New Election section below.

Name

Street address

City

State

ZIP code

Certificate of Authority number

Employer identification number (EIN) (if different)

Consent to New Election — The party previously designated to claim the bad debt credits or refunds related to the accounts described

above hereby consents to the new election as provided in this form. I certify that I am authorized to execute this consent on behalf of the

named party. I make these statements with the knowledge that knowingly making a false or fraudulent statement on this document is a

misdemeanor under Tax Law section 1817 and a Class E felony under Penal Law section 175.35, punishable by imprisonment for up to

four years and a fine of up to $50,000 for an individual or $250,000 for a corporation. I understand that the Tax Department is authorized to

investigate the validity and accuracy of any information entered on this form.

Type or print name and title of owner, partner, or other authorized person

Signature of owner, partner, or other authorized person

Date

General information

Note: This form is valid only for claims for refund or credit filed before July 1, 2010. No refund or credit may be claimed under former Tax Law

section 1132(e-1) on or after July 1, 2010, regardless of the date of the underlying sales tax transaction or the date the bad debt is written off.

For a vendor or lender to be eligible to claim a refund or credit of sales tax, the following conditions and requirements must be met:

• the vendor has reported and paid the sales tax;

• no refund or credit was previously claimed or allowed on any portion of the account;

• the account is worthless, in whole or in part, and has been charged off by the private label credit card lender for federal income tax

purposes or, if the lender is not required to file a federal income tax return, the account has been charged off in accordance with

generally accepted accounting principles;

• any contract between the vendor and the private label credit card lender under which the private label credit card lender has the right

to the account contains an irrevocable relinquishment of all rights to the account by the vendor and a transfer of those rights to the

private label credit card lender, except for the right to the bad debt refund or credit if retained by the vendor;

• the lender and the vendor have filed this joint election form with the Tax Department designating which of those parties is entitled to

claim the refund or credit;

• any party designated in this election form to claim the refund or credit is deemed to be a vendor for purposes of Tax Law Article 28

and the designated party must comply with all of the obligations of a vendor including registering with the Tax Department as a person

required to collect tax, if not already registered, and maintaining records; and

• the party electing to claim the refund or credit files the claim in a manner prescribed by the Tax Department.

For purposes of reviewing and processing any refund or credit claim made pursuant to this election form, the Tax Department will

recognize only the entity designated herein as having the right to receive any refund or credit that may be approved. If the designated

entity has elected to have the Tax Department pay the amount of any approved refund or credit to either its affiliate (as defined in Internal

Revenue Code section 1504) or its assignee, it must so notify the Tax Department. The affiliate or assignee must be registered with the Tax

Department as a person required to collect sales tax pursuant to Tax Law section 1134.

An election made pursuant to former Tax Law section 1132(e-1) cannot be amended or revoked except by filing a new election signed by all

parties. The most recently filed election will govern.

Authority to sign Form ST-55

This election form must be signed by an owner, officer, partner or other duly authorized representative of the vendor and the private label

credit card lender (or lender’s affiliate or assignee). Other duly authorized representatives include persons appointed to act on behalf of a

party under a valid power of attorney or pursuant to a corporate resolution.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2