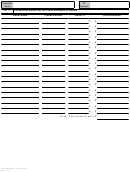

Schedule Aftc-1 - West Virginia Schedule Aftc-1 Alternative-Fuel Tax Credit Page 9

ADVERTISEMENT

Compute the Qualified Alternative-Fuel Vehicle Refueling

of their own Schedule AFTC-1

Infrastructure as the smaller of the value on line 5 (potential

Enter the total of credit allocated on Part A, line 4.

credit) and the value on line 6 (maximum allowable credit). Also,

enter the value on part A, line 3.

P

F – u

A

-F

t

Art

nused

lternAtive

uel

Ax

C

A

o

P

e – A

-F

M

v

redit

lloCAtion to

wners

Art

lternAtive

uel

otor

ehiCle

t

C

/

Q

A

-

Ax

redit And

or

uAliFied

lternAtive

When the Taxpayer that earns original entitlement to

F

r

i

t

C

uel

eFueling

nFrAstruCture

Ax

redit

Alternative-Fuel Tax Credit is a pass-through entity, any

A

P

-t

e

credit unused to offset the tax liability of the pass-through

lloCAted FroM

Ass

hrough

ntity

entity is to be allocated to the owners of the pass-through

Enter the name and Employer Identification Number (EIN)

entity in the same manner that distributive share flows

of the Pass-Through Entity and the amount of Alternative-

through to the equity owners.

Fuel Motor Vehicle Tax Credit and/or Qualified Alternative-

Enter

the

name,

identification

number,

ownership

Fuel Refueling Infrastructure Tax Credit allocated to you

percentage, and amount of unused credit allocated for each

as an owner of the Pass-Through Entity. The Pass-Through

equity owner.

Entity must establish original entitlement to Alternative-

Fuel Motor Vehicle Tax Credit and/or Qualified Alternative-

Enter the total allocated credit on Part A, line 16.

Fuel Refueling Infrastructure Tax Credit through the filing

5

Alternative Fuel Tax Credit – Information and Instructions

(Rev. 1-14)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9