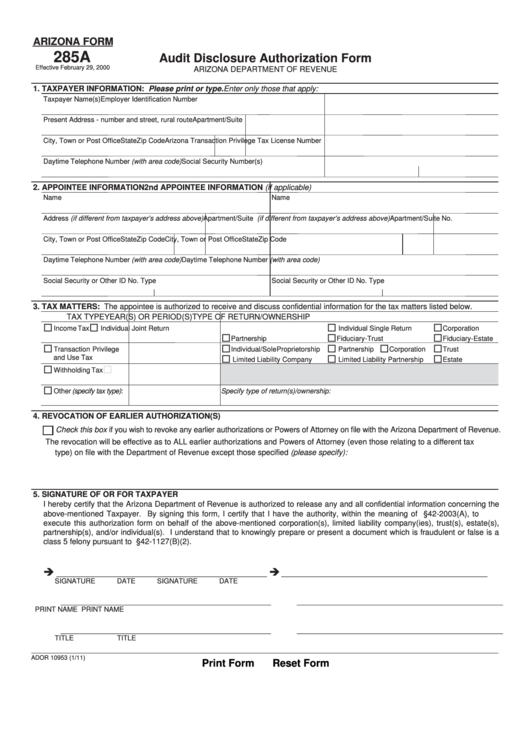

ARIZONA FORM

285A

Audit Disclosure Authorization Form

Effective February 29, 2000

ARIZONA DEPARTMENT OF REVENUE

1. TAXPAYER INFORMATION: Please print or type.

Enter only those that apply:

Taxpayer Name(s)

Employer Identification Number

Present Address - number and street, rural route

Apartment/Suite No.

Arizona Withholding Number

City, Town or Post Office

State

Zip Code

Arizona Transaction Privilege Tax License Number

Daytime Telephone Number (with area code)

Social Security Number(s)

2. APPOINTEE INFORMATION

2nd APPOINTEE INFORMATION (if applicable)

Name

Name

Address (if different from taxpayer’s address above) Apartment/Suite No. Address (if different from taxpayer’s address above) Apartment/Suite No.

City, Town or Post Office

State

Zip Code

City, Town or Post Office

State

Zip Code

Daytime Telephone Number (with area code)

Daytime Telephone Number (with area code)

Social Security or Other ID No.

Type

Social Security or Other ID No.

Type

|

|

3. TAX MATTERS: The appointee is authorized to receive and discuss confidential information for the tax matters listed below.

TAX TYPE

YEAR(S) OR PERIOD(S)

TYPE OF RETURN/OWNERSHIP

Income Tax

Individual Joint Return

Individual Single Return

Corporation

Partnership

Fiduciary-Trust

Fiduciary-Estate

Transaction Privilege

Individual/Sole Proprietorship

Partnership

Corporation

Trust

and Use Tax

Limited Liability Company

Limited Liability Partnership

Estate

Withholding Tax

Other (specify tax type):

Specify type of return(s)/ownership:

4. REVOCATION OF EARLIER AUTHORIZATION(S)

Check this box if you wish to revoke any earlier authorizations or Powers of Attorney on file with the Arizona Department of Revenue.

The revocation will be effective as to ALL earlier authorizations and Powers of Attorney (even those relating to a different tax

type) on file with the Department of Revenue except those specified (please specify):

5. SIGNATURE OF OR FOR TAXPAYER

I hereby certify that the Arizona Department of Revenue is authorized to release any and all confidential information concerning the

above-mentioned Taxpayer. By signing this form, I certify that I have the authority, within the meaning of A.R.S. §42-2003(A), to

execute this authorization form on behalf of the above-mentioned corporation(s), limited liability company(ies), trust(s), estate(s),

partnership(s), and/or individual(s). I understand that to knowingly prepare or present a document which is fraudulent or false is a

class 5 felony pursuant to A.R.S. §42-1127(B)(2).

________________________________________________

_______________________________________________

SIGNATURE

DATE

SIGNATURE

DATE

________________________________________________

_______________________________________________

PRINT NAME

PRINT NAME

________________________________________________

_______________________________________________

TITLE

TITLE

ADOR 10953 (1/11)

Print Form

Reset Form

1

1