Form 2743 - Request To Rescind Qualified Agricultural Property Exemption

ADVERTISEMENT

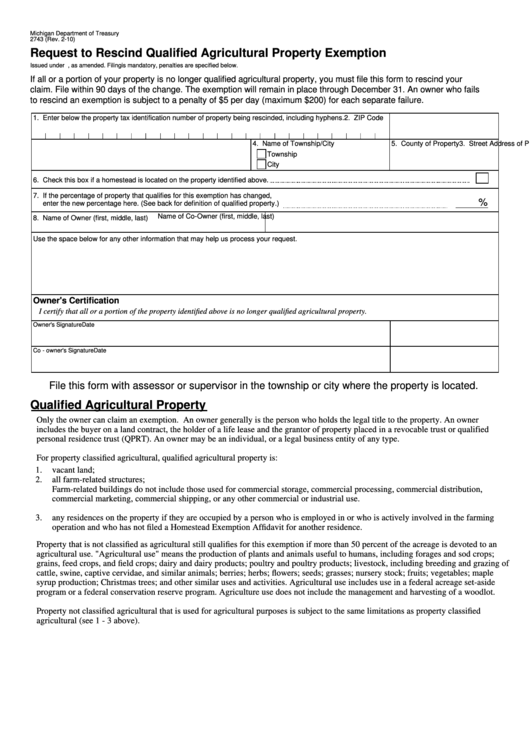

Michigan Department of Treasury

2743 (Rev. 2-10)

Request to Rescind Qualified Agricultural Property Exemption

Issued under P.A. 237 of 1994, as amended. Filing is mandatory, penalties are specified below.

If all or a portion of your property is no longer qualified agricultural property, you must file this form to rescind your

claim. File within 90 days of the change. The exemption will remain in place through December 31. An owner who fails

to rescind an exemption is subject to a penalty of $5 per day (maximum $200) for each separate failure.

1. Enter below the property tax identification number of property being rescinded, including hyphens.

2. ZIP Code

3. Street Address of Property

4. Name of Township/City

5. County of Property

Township

City

6. Check this box if a homestead is located on the property identified above.

7. If the percentage of property that qualifies for this exemption has changed,

%

enter the new percentage here. (See back for definition of qualified property.)

Name of Co-Owner (first, middle, last)

8. Name of Owner (first, middle, last)

Use the space below for any other information that may help us process your request.

Owner's Certification

I certify that all or a portion of the property identified above is no longer qualified agricultural property.

Owner's Signature

Date

Co - owner's Signature

Date

File this form with assessor or supervisor in the township or city where the property is located.

Qualified Agricultural Property

Only the owner can claim an exemption. An owner generally is the person who holds the legal title to the property. An owner

includes the buyer on a land contract, the holder of a life lease and the grantor of property placed in a revocable trust or qualified

personal residence trust (QPRT). An owner may be an individual, or a legal business entity of any type.

For property classified agricultural, qualified agricultural property is:

1.

vacant land;

2.

all farm-related structures;

Farm-related buildings do not include those used for commercial storage, commercial processing, commercial distribution,

commercial marketing, commercial shipping, or any other commercial or industrial use.

3.

any residences on the property if they are occupied by a person who is employed in or who is actively involved in the farming

operation and who has not filed a Homestead Exemption Affidavit for another residence.

Property that is not classified as agricultural still qualifies for this exemption if more than 50 percent of the acreage is devoted to an

agricultural use. "Agricultural use" means the production of plants and animals useful to humans, including forages and sod crops;

grains, feed crops, and field crops; dairy and dairy products; poultry and poultry products; livestock, including breeding and grazing of

cattle, swine, captive cervidae, and similar animals; berries; herbs; flowers; seeds; grasses; nursery stock; fruits; vegetables; maple

syrup production; Christmas trees; and other similar uses and activities. Agricultural use includes use in a federal acreage set-aside

program or a federal conservation reserve program. Agriculture use does not include the management and harvesting of a woodlot.

Property not classified agricultural that is used for agricultural purposes is subject to the same limitations as property classified

agricultural (see 1 - 3 above).

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1