Disclosure of Property Acquired From

SCHEDULE A

(Form 8939)

the Decedent (and Recipient Statement)

Recipients of Schedule A: For more information and details on the information shown on

Department of the Treasury

Internal Revenue Service

this schedule, see the instructions for Form 8939 and

Decedent’s Social Security Number

Estate of:

Number

of

Complete a separate Schedule A for each recipient of property, including the decedent’s estate. See instructions.

Part I

General Information

1a Name of executor

1b Executor’s address (number and street including apartment or suite

number; city, town, or post office; state; and ZIP code) and phone number.

1c Estate's taxpayer identification number (TIN)

Phone no. (

)

2a Name and address of recipient

2b Recipient’s taxpayer identification number (TIN)

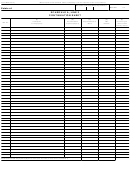

Part II

Property Information

3 For all property acquired from the decedent by the recipient named in line 2a the basis of which at the date of death is greater than or equal to its

fair market value at the date of death, provide the following information. See instructions.

(a)

(b)

(c)

(d)

(e)

Description

Date decedent

Adjusted basis at

FMV

Amount of gain

Item No.

of property

acquired property

death

at death

that would be

ordinary income

3A Totals from continuation schedules (or additional sheets) attached to this schedule

(If more space is needed, attach the continuation schedule at the end of this Form).

4 For all property acquired from the decedent by the recipient named in line 2a the basis of which at the date of death is less than fair market value

at the date of death, provide the following information. By checking the box in column (e)(ii) on line 4 for each item of property that was sold prior

to distribution and to which I am allocating Spousal Property Basis Increase, I hereby certify in accordance with section 4.02(3) of Revenue

Procedure 2011-41 that all of the net proceeds from the sale of such property or property interest to which Spousal Property Basis Increase has

been allocated will be distributed to or for the benefit of the surviving spouse in a manner that would qualify property as qualified spousal

property, as defined in section 1022(c)(3). See instructions.

(a)

(b)

(c)

(d)

(e)*

(f)

Description

Date decedent

Adjusted basis

FMV at death

Allocation of basis increase

Amount of gain

of property

acquired

at death

that would be

Item

ordinary income

property

(i)

(ii)

No.

General basis

Spousal property

basis increase

increase

4A Totals from continuation schedules (or additional sheets) attached to this schedule

4B Total for columns (e)(i) and (e)(ii)

* The sum of the amounts in columns (e)(i) and (e)(ii) on each line cannot exceed the difference between the amounts in columns (c) and (d) on

that line.

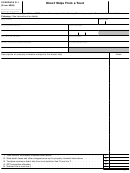

Schedule A—Page 2

1

1 2

2 3

3 4

4 5

5 6

6 7

7