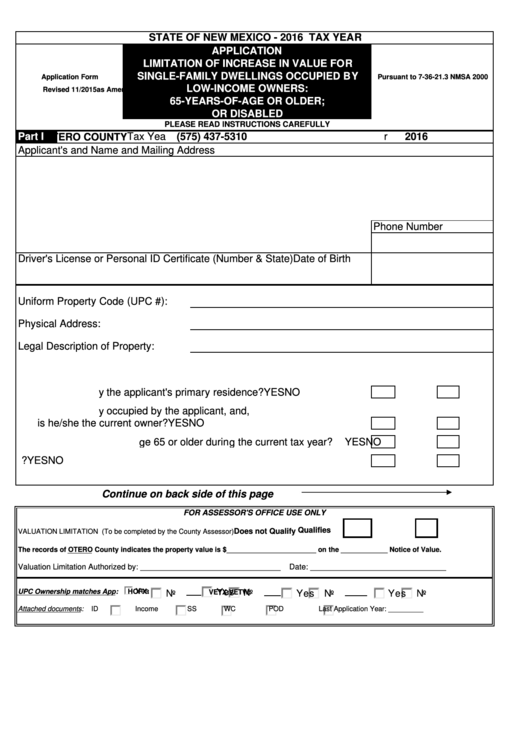

Application Limitation Of Increase In Value For Single-Family Dwellings Occupied By Low-Income Owners: 65-Years-Of-Age Or Older; Or Disabled - State Of New Mexico

ADVERTISEMENT

STATE OF NEW MEXICO - 2016 TAX YEAR

APPLICATION

LIMITATION OF INCREASE IN VALUE FOR

SINGLE-FAMILY DWELLINGS OCCUPIED BY

Application Form

Pursuant to 7-36-21.3 NMSA 2000

LOW-INCOME OWNERS:

Revised 11/2015

as Amended in 2013

65-YEARS-OF-AGE OR OLDER;

OR DISABLED

PLEASE READ INSTRUCTIONS CAREFULLY

Part I

Tax Year

OTERO COUNTY

(575) 437-5310

2016

Applicant's and Name and Mailing Address

Phone Number

Driver's License or Personal ID Certificate (Number & State)

Date of Birth

Uniform Property Code (UPC #):

Physical Address:

Legal Description of Property:

A. Is the property the applicant's primary residence?

YES

NO

B. Is the property occupied by the applicant, and,

is he/she the current owner?

YES

NO

C. Will the applicant be age 65 or older during the current tax year?

YES

NO

D. Is the applicant disabled?

YES

NO

Continue on back side of this page

FOR ASSESSOR'S OFFICE USE ONLY

Qualifies

Does not Qualify

VALUATION LIMITATION (To be completed by the County Assessor)

The records of OTERO County indicates the property value is $_______________________ on the ____________ Notice of Value.

Valuation Limitation Authorized by: ________________________________

Date: _______________________________

Yes

Yes

UPC Ownership matches App :

HOFX:

No

VETX:

VETW:

No

Yes

No

Yes

No

Attached documents :

ID

Income

SS

WC

POD

Last Application Year: _________

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3