Reset Form

Print Form

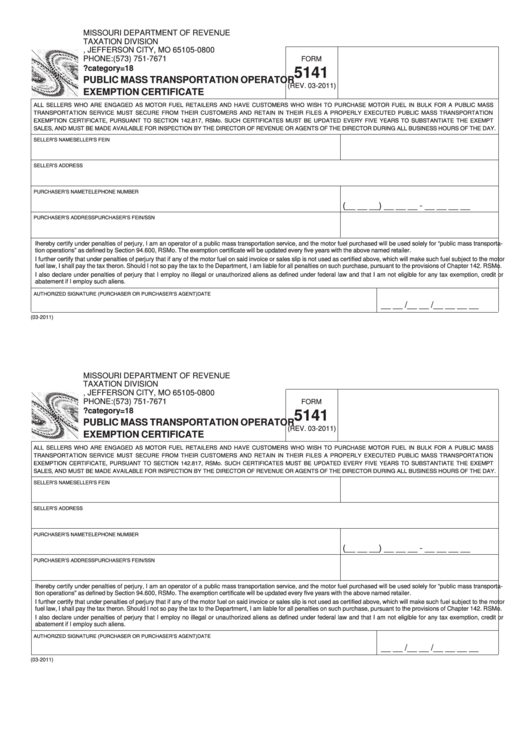

MISSOURI DEPARTMENT OF REVENUE

TAXATION DIVISION

P.O. BOX 800, JEFFERSON CITY, MO 65105-0800

PHONE: (573) 751-7671

FORM

5141

PUBLIC MASS TRANSPORTATION OPERATOR

(REV. 03-2011)

EXEMPTION CERTIFICATE

ALL SELLERS WHO ARE ENGAGED AS MOTOR FUEL RETAILERS AND HAVE CUSTOMERS WHO WISH TO PURCHASE MOTOR FUEL IN BULK FOR A PUBLIC MASS

TRANSPORTATION SERVICE MUST SECURE FROM THEIR CUSTOMERS AND RETAIN IN THEIR FILES A PROPERLY EXECUTED PUBLIC MASS TRANSPORTATION

EXEMPTION CERTIFICATE, PURSUANT TO SECTION 142.817, RSMo. SUCH CERTIFICATES MUST BE UPDATED EVERY FIVE YEARS TO SUBSTANTIATE THE EXEMPT

SALES, AND MUST BE MADE AVAILABLE FOR INSPECTION BY THE DIRECTOR OF REVENUE OR AGENTS OF THE DIRECTOR DURING ALL BUSINESS HOURS OF THE DAY.

SELLER’S NAME

SELLER’S FEIN

SELLER’S ADDRESS

PURCHASER’S NAME

TELEPHONE NUMBER

(__ __ __) __ __ __ - __ __ __ __

PURCHASER’S ADDRESS

PURCHASER’S FEIN/SSN

I hereby certify under penalties of perjury, I am an operator of a public mass transportation service, and the motor fuel purchased will be used solely for “public mass transporta-

tion operations” as defined by Section 94.600, RSMo. The exemption certificate will be updated every five years with the above named retailer.

I further certify that under penalties of perjury that if any of the motor fuel on said invoice or sales slip is not used as certified above, which will make such fuel subject to the motor

fuel law, I shall pay the tax theron. Should I not so pay the tax to the Department, I am liable for all penalties on such purchase, pursuant to the provisions of Chapter 142. RSMo.

I also declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax exemption, credit or

abatement if I employ such aliens.

AUTHORIZED SIGNATURE (PURCHASER OR PURCHASER’S AGENT)

DATE

__ __ /__ __ /__ __ __ __

(03-2011)

MISSOURI DEPARTMENT OF REVENUE

TAXATION DIVISION

P.O. BOX 800, JEFFERSON CITY, MO 65105-0800

PHONE: (573) 751-7671

FORM

5141

PUBLIC MASS TRANSPORTATION OPERATOR

(REV. 03-2011)

EXEMPTION CERTIFICATE

ALL SELLERS WHO ARE ENGAGED AS MOTOR FUEL RETAILERS AND HAVE CUSTOMERS WHO WISH TO PURCHASE MOTOR FUEL IN BULK FOR A PUBLIC MASS

TRANSPORTATION SERVICE MUST SECURE FROM THEIR CUSTOMERS AND RETAIN IN THEIR FILES A PROPERLY EXECUTED PUBLIC MASS TRANSPORTATION

EXEMPTION CERTIFICATE, PURSUANT TO SECTION 142.817, RSMo. SUCH CERTIFICATES MUST BE UPDATED EVERY FIVE YEARS TO SUBSTANTIATE THE EXEMPT

SALES, AND MUST BE MADE AVAILABLE FOR INSPECTION BY THE DIRECTOR OF REVENUE OR AGENTS OF THE DIRECTOR DURING ALL BUSINESS HOURS OF THE DAY.

SELLER’S NAME

SELLER’S FEIN

SELLER’S ADDRESS

PURCHASER’S NAME

TELEPHONE NUMBER

(__ __ __) __ __ __ - __ __ __ __

PURCHASER’S ADDRESS

PURCHASER’S FEIN/SSN

I hereby certify under penalties of perjury, I am an operator of a public mass transportation service, and the motor fuel purchased will be used solely for “public mass transporta-

tion operations” as defined by Section 94.600, RSMo. The exemption certificate will be updated every five years with the above named retailer.

I further certify that under penalties of perjury that if any of the motor fuel on said invoice or sales slip is not used as certified above, which will make such fuel subject to the motor

fuel law, I shall pay the tax theron. Should I not so pay the tax to the Department, I am liable for all penalties on such purchase, pursuant to the provisions of Chapter 142. RSMo.

I also declare under penalties of perjury that I employ no illegal or unauthorized aliens as defined under federal law and that I am not eligible for any tax exemption, credit or

abatement if I employ such aliens.

AUTHORIZED SIGNATURE (PURCHASER OR PURCHASER’S AGENT)

DATE

__ __ /__ __ /__ __ __ __

(03-2011)

1

1