Form Ut-008 - Application For Exemption Of Waste Treatment Facility - Utility

ADVERTISEMENT

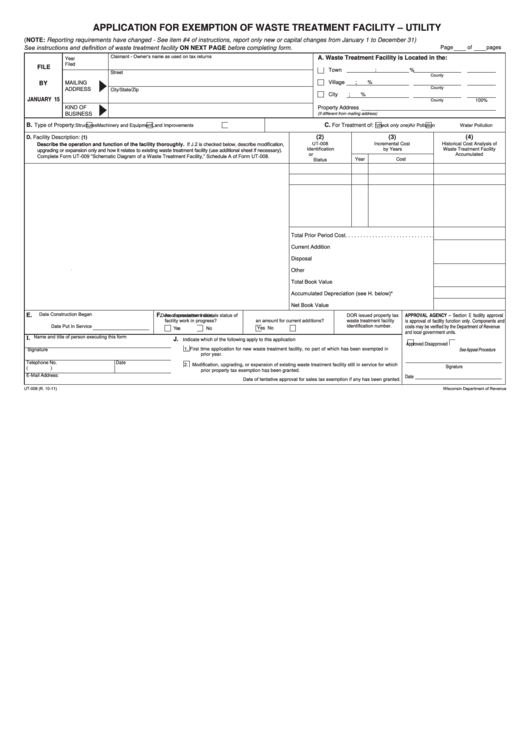

APPLICATION FOR EXEMPTION OF WASTE TREATMENT FACILITY – UTILITY

(NOTE: Reporting requirements have changed - See item #4 of instructions, report only new or capital changes from January 1 to December 31)

See instructions and definition of waste treatment facility ON NEXT PAGE before completing form.

Page

of

pages

Claimant ‑ Owner’s name as used on tax returns

A. Waste Treatment Facility is Located in the:

Year

Filed

FILE

Town

;

%

Street

County

Village

;

%

BY

MAILING

County

ADDRESS

City/State/Zip

City

;

%

JANUARY 15

County

100%

KIND OF

Property Address

BUSINESS

(if different from mailing address)

Land Improvements

Machinery and Equipment

Structures

Air Pollution

Water Pollution

B.

C.

Type of Property:

For Treatment of:

(check only one)

(2)

(3)

(4)

D. Facility Description:

(1)

UT‑008

Incremental Cost

Historical Cost Analysis of

Describe the operation and function of the facility thoroughly. If J.2 is checked below, describe modification,

Identification

upgrading or expansion only and how it relates to existing waste treatment facility (use additional sheet if necessary).

by Years

Waste Treatment Facility

Accumulated

or C.W.I.P.

Complete Form UT‑009 “Schematic Diagram of a Waste Treatment Facility,” Schedule A of Form UT‑008.

Status

Year

Cost

Total Prior Period Cost. . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Current Addition . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Disposal . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Other . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Total Book Value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Accumulated Depreciation (see H. below)* . . . . . . . . . . . . . .

Net Book Value . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

Date Construction Began

APPROVAL AGENCY – Section E facility approval

As of assessment date, is status of

Does depreciation include

DOR issued property tax

E.

F.

G.

H.

facility work in progress?

an amount for current additions?

is approval of facility function only. Components and

waste treatment facility

identification number.

Date Put In Service

costs may be verified by the Department of Revenue

Yes

No

Yes

No

and local government units.

Name and title of person executing this form

I.

J.

Indicate which of the following apply to this application

Approved

Disapproved

See Appeal Procedure

Signature

1. First time application for new waste treatment facility, no part of which has been exempted in

prior year.

Telephone No.

Date

2. Modification, upgrading, or expansion of existing waste treatment facility still in service for which

Signature

(

)

prior property tax exemption has been granted.

Date

E-Mail Address:

Date of tentative approval for sales tax exemption if any has been granted.

UT‑008 (R. 10‑11)

Wisconsin Department of Revenue

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2