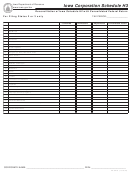

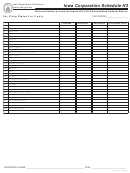

Form 42-021b - Iowa Corporation Schedule H1 Page 2

ADVERTISEMENT

Schedule H General Instructions

This schedule must be used when the corporation files as part of a consolidated group for federal purposes. Use extra pages if

necessary to list all companies included in the consolidated federal return.

Iowa Schedule H has three parts:

. .

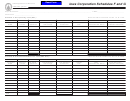

Schedule H1 calculates the federal tax deduction/refund.

Information from the consolidating income statements for each company included in the consolidated federal return is entered on

.

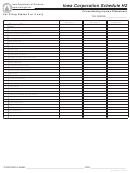

Schedule H2.

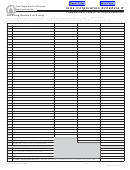

Schedule H3 is used to reconcile the consolidating income statements (Schedule H2) with the consolidated federal return.

The allowed federal tax deduction is 50% of the federal income taxes paid or accrued. The deduction should be computed using one

of the following methods.

ACCRUAL BASIS taxpayers should determine the total tax shown on page 1 of federal form 1120 and use the formula shown below.

CASH BASIS taxpayers should compute the sum of federal taxes paid during the current tax period and federal motor fuel tax credits

applied against the tax liability for the current tax period, less any federal refunds received during the current tax period using the

formula shown below on each period producing payments or refunds.

Separate Company

Total Tax

=

Federal Taxable Income

Federal Tax

Reported on the

X 50%

X

Deduction

Consolidated

Sum of All Positive Income Producing

Federal Return

Companies Included in the

Consolidated Taxable Income

Statements

If your company files a consolidated Iowa return, the numerator in the above equation is the sum of the incomes of the profit

companies included in the consolidated Iowa return. This formula is referred to as the “revenue producers formula.” The federal tax

deduction is reported on IA 1120, line 5.

If the federal consolidated return reports a net operating loss which is carried back, the federal refund is computed substituting loss

companies in place of taxable income companies in the above formula. This formula is known as the “loss producers formula.” The

federal refund is reported on IA 1120, line 2, in the loss year.

Schedule H1 Instructions

List in column A the federal taxable income after the net operating loss and special deductions or in column B the federal taxable loss

for each company computed as if a separate federal corporation income tax return was filed. Normally, this would be from the federal

1120, line 30.

Complete lines 46 through 50 of Schedule H as follows:

Line 46: Show federal taxable income of the profit company(s) reported on this Iowa return.

Line 47: Enter the total from line 43, column A.

Line 48: Enter federal tax from the federal 1120.

Line 50: Divide line 46 by line 47 and multiply the result by line 48 and by 50%. Enter on IA 1120, line 5.

42-021b (09/18/12)

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4