INSTRUCTIONS FOR FORM PAR 101

POWER OF ATTORNEY AND DECLARATION OF REPRESENTATIVE

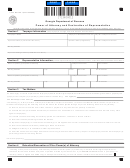

GENERAL

Purpose. Use Form PAR 101 to authorize an individual to represent you before the Virginia Department of Taxation. The

individual you authorize should be registered as a Virginia Authorized Agent. A Virginia Authorized Agent is not required

to be an enrolled agent. The Virginia Authorized Agent designation simply means that the individual has registered with

the Virginia Department of Taxation as a representative for taxpayers. The authorized agent will be eligible to receive any

correspondence, documentation, or other written materials that relate to specific tax matters for which the Virginia Power of

Attorney and Declaration of Representative form has been filed.

LINE 1- Taxpayer Information

Individuals. Enter your name, your street address or post office box and social security number (SSN). Do not use your

representative’s address or post office box. If a joint return has been filed, or will be filed and you and your spouse are

designating the same representative(s), also enter your spouse’s name and SSN and your spouse’s address if different from

yours. Enter your daytime telephone number(s) and email address.

Corporations, partnerships, or associations. Enter the name, business address, federal identification number, telephone

number of the contact person, and email address. If this form is being prepared for corporations filing a consolidated or a

combined tax return, do not attach a list of subsidiaries or affiliated corporations to this form. Only the parent corporation‘s

information is required on line 1. A subsidiary or affiliate must file its own PAR 101 for returns that must be filed separately.

Employee plan or exempt organization. Enter the name, the three-digit plan number and address of the plan, the federal

identification number of the plan sponsor or exempt organization, the telephone number, and email address.

Trust. Enter the name and federal identification number (FEIN) of the Trust, followed by the name, title, address, telephone

number, and email address of the Trustee.

Estate and Inheritance. Enter the name and identification number of the Estate, followed by the name, title, address,

telephone number, and email address of the decedent’s administrator, executor, or personal representative.

Note: The identification number can be either a federal identification number or social security number.

LINE 2 - Representative(s)

Enter your representative’s full name, telephone and fax numbers and e-mail address. Only individuals may be named

as representatives. Use the identical full name on all submissions and correspondence. If applicable, enter alternative

representatives. Only one representative can be listed in each box.

Enter the Virginia Authorized Agent Number (if applicable) for each representative. If the Virginia Authorized Agent number

has not been assigned or is not known, leave blank and one will be assigned to your representative if applicable or necessary.

The Virginia authorized agent number is a unique identification number (not the SSN, EIN, PTIN, or enrollment card number)

that the Department of Taxation assigns to representatives. The representative should use the assigned Virginia authorized

agent number on all future powers of attorney.

If your representative does not have a Virginia Authorized Agent number, a Form R-7 must be completed by him or her so

that the number may be obtained. The Form R-7 is located on the Department of Taxation’s website:

Only the representatives listed on line 2 will receive written copies of correspondence sent to the taxpayer by the Department

that relates to the tax matter for which the power of attorney was filed. Additional representatives may be requested by

attaching a separate list. Be sure to include the representative’s full name, Virginia Authorized Agent Number (if applicable),

telephone, fax number and e-mail address.

Note: The additional representatives will not be mailed copies of any correspondence.

LINE 3 - Tax Matters

Enter the Virginia Tax Account Number, type of tax and the beginning and ending period(s) in order for the power of attorney

to be valid. An example of an individual account number is 33-999999999S-001 where 33 denotes individual income tax and

999999999S denotes the social security number. An example of a business account number is 35-999999999F-001 where

35 denotes corporation income tax and 999999999F denotes the FEIN. For taxes due annually, you may list the year only

instead of the beginning and ending periods. The following taxes are annual taxes for which you may list a year only: Apple

Excise Tax, Bank Franchise Tax, Corporate Income Tax, Fiduciary Income Tax, Individual Consumer Use Tax, Individual Income

Tax, Litter Tax, Rolling Stock Tax on Railroads and Freight Car Companies, Soft Drink Excise Tax, and any other annual tax.

Do not use a general reference such as “All years,” “All periods,” or “All taxes.” Any power of attorney with a general reference

will be returned. Representation can only be granted for the years or periods listed on line 3. If the matter relates to estate

tax, enter the date of the decedent’s death in the Beginning Period and Ending Period columns instead of the year or period.

2601148 (Rev. 06/11)

1

1 2

2 3

3 4

4