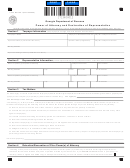

You may list the current year/period and any tax years or periods that have already ended as of the date you sign the power

of attorney. You may include on a Power of Attorney and Declaration of Representative, only future tax periods that end no

later than 3 years after the date the power of attorney is received. The 3 future periods are determined starting after December

31 of the year the power of attorney is received. You must enter the type of tax, and the future year(s) or period(s). If more

space is needed, please complete an additional Form PAR 101.

LINE 4 - Electronic Notices and Communications

If you check the box on line 4, copies of e-mail communications that relate to the tax matter for which the power of attorney

was filed will be sent to the person designated as a power of attorney.

Note: Traditional or non-secure e-mail is still available, but we will not send account specific information by this method.

Taxpayers may use secure e-mail to discuss specific questions related to the account. The authorized representative(s) will

receive copies of this secure e-mail communication through U.S.Mail. To use secure e-mail on the Department of Taxation’s

website at , log into iFile (Business or Individual) or iReg, select Secure Message to send and receive

secure e-mail.

LINE 5 - Acts Authorized

List any previous powers of attorney granted for the same period and tax type that you do not want revoked by this form.

LINE 6 - Signatures of Taxpayer(s)

Individuals. You must sign and date the power of attorney. If a joint return has been filed and both husband and wife will be

represented by the same individual(s), both must sign the power of attorney. However, if a joint return has been filed and the

husband and wife will be represented by different individuals, each spouse must execute his or her own power of attorney

on a separate Form PAR 101.

Corporations or associations. An officer having authority to bind the taxpayer must sign.

Partnerships. All partners must sign unless only one partner is authorized to act in the name of the partnership. A partner

is authorized to act in the name of the partnership if, under state law, the partner has authority to bind the partnership. A

copy of such authorization must be attached. For dissolved partnerships, see federal Regulations section 601.503(c)(6).

All others. If the taxpayer is a dissolved corporation, decedent, insolvent, or a person for whom or by whom a fiduciary (a

trustee, guarantor, receiver, executor, or administrator) has been appointed, see federal Regulations section 601.503(d).

Note. Generally the taxpayer signs first, granting the authority and then the representative signs, accepting the authority

granted. The date for both the taxpayer and the representative must be within 45 days for domestic authorizations and within

60 days for authorization from taxpayers residing abroad. If the taxpayer signs last, then there is no time frame requirement.

LINE 7 - Declaration and Signature of Representative and Virginia Power of Attorney Number. Enter the representative(s)

Virginia Authorized Agent Number.

Designation. The representative(s) must list the one of the following in the “Designation” column:

a

Attorney

Certified Public Accountant

b

c

Enrolled Agent

Officer - Enter the title of the officer (for example, President, Vice President, or Secretary).

d

e

Full-Time Employee - Enter title or position (for example, Comptroller or Accountant).

f

Family Member - Circle the relationship to taxpayer (must be a spouse, parent, child, brother, or sister).

g

Other - List any other representative type not listed above and provide a brief description.

Jurisdiction. Enter the two-letter abbreviation for the state (for example, “MD” for Maryland) in which licensed to practice

or the enrollment card number issued by the Office of Professional Responsibility.

Signature of representative(s). Each representative must sign and date the power of attorney and declaration of

representative.

Where to Mail. Mail the completed copy of the Form PAR 101 to:

Virginia Department of Taxation

Individual Fax:

804-254-6113

P.O. Box 1115

Business Fax:

804-254-6111

Richmond Virginia 23218-1115

For individual assistance call:

804-367-8031

For business assistance call:

804-367-8037

1

1 2

2 3

3 4

4