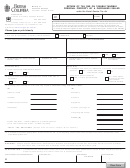

2699, Page 2

Instructions for Completing Form 2699, 2014 Statement of

“Qualified Personal Property” by a “Qualified Business”

“Qualified personal property” made available by a

(B)

It is property that is subject to an agreement

“qualified business” may be assessed to its user

(frequently titled a lease) entered into

provided this form is completed and filed with the

after

December 31, 1993. Additionally,

assessor no later than February 1, 2014. Read the

the agreement must meet the following four (4)

following instructions to determine whether you are

requirements:

a “qualified business” and whether your personal

property is “qualified personal property.”

(a)

It must be for a noncancelable term of 12

months or more.

(1) DEFINITIONS:

(b)

The party that becomes the user or possessor

“Qualified Business” is a business that meets the

of the personal property must be engaged in a for-profit

following two (2) requirements:

business.

(A) It is a for-profit business.

(c)

The user or possessor can obtain legal title

to the property by making all of the periodic payments

•

(B) It obtains services relating to the business

or by making all of the periodic payments plus a final

from 30 or fewer employees during a week selected

payment if the final payment is less than the true cash

at random by the State Tax Commission no later than

value of the property. The true cash value is determined

January 15, 2014. “Employees” means persons who

by using the personal property multipliers on Form 632

perform a service for wages or other remuneration under

(L-4175), Personal Property Statement.

a contract of hire, written or oral, expressed or implied.

“Employees” includes employees of independent

(d) The agreement must require the user or possessor

contractors performing services substantially similar

of the property to report the properties to the assessor

to employees. If a person is an entity under common

on a personal property statement on or before February

control or is a member of an affiliated group as those

20 and must require the user to pay the property tax.

terms are defined below, the number of employees from

whom services are obtained includes all employees of

(2) If the “qualified business” is the manufacturer of

the group and of independent contractors of the group

the personal property that is made available for use

rendering services to the qualified business.

by another, the “qualified business” must report the

original selling price in the “Purchase Price” column. If

An “affiliated group” means 2 or more corporations, 1

there is no original selling price, the qualified business

of which owns or controls, directly or indirectly, 80% or

must report the original cost. See also instruction # 3.

more of the capital stock with voting rights of the other

corporation or corporations.

(3) Purchase price must include sales tax, freight,

and installation.

An “entity under common control” — is as defined in

the Michigan Revenue Administrative Bulletin 1989-

(4) The location of the property is as indicated in the

48. You may obtain a copy from Treasury's website

records of the “qualified business.”

at

(5) You may list “Mo” for monthly or “Yr” for yearly.

“Qualified Personal Property” is property that meets

the following two (2) requirements:

(A) It is property on which a retail sales tax has been

paid or on which liability accrued at the same time as

the user acquired possession of the property or on

which sales tax would be payable if the property was

not exempt from the tax.

1

1 2

2