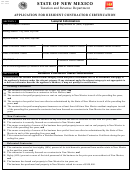

Form Acd-31050 - Application For Nontaxable Transaction Certificates Page 2

ADVERTISEMENT

1

NTTC TYPE DESCRIPTIONS

Type 2 certificates may be executed:

license number on the application or submit proof that such a number is

1) By manufacturers for the purchase of tangible personal property that will

not required.

2

become an ingredient or component of the manufactured product. (7-9-46)

4) For the lease of construction equipment that is used at the construction

2) For the purchase of tangible personal property or licenses for resale either

location of a construction project that is either subject to gross receipts tax

alone or in combination with other tangible personal property or licenses in

upon completion, upon the sale in the ordinary course of business of the real

the ordinary course of business. (7-9-47)

property upon which the project is constructed or that takes place on Indian

3) By a lessee for the lease of tangible personal property or licenses for

tribal territory. (7-9-52.1) Enter your contractor’s license number on the ap-

subsequent lease in the ordinary course of business, except for the lease

plication or submit proof that such a number is not require.

2

of furniture or appliances, the receipts from the rental or lease of which are

deductible under Subsection C of Section 7-9-53, the lease of coin-operated

Type 9 certificates may be executed for the purchase of tangible personal

machines, and for the purchase of manufactured homes as defined in Section

property only and may not be used for the purchase of services, the pur-

7-9-3(G). (7-9-50)

chase of a license or other intangible property, for the lease of property or to

4) For the purchase of tangible personal property or licenses for subsequent

purchase construction materials for use in construction projects (except as

lease in the ordinary course of business, except for the lease of furniture

provided in #2 below). The following may execute Type 9 NTTCs:

or appliances, the receipts from the rental or lease of which are deductible

1) Governmental agencies. (7-9-54)

under Subsection C of Section 7-9-53; the lease of coin-operated machines,

2) 501(c)(3) organizations. (7-9-60) These organizations register with the

and for the purchase of manufactured homes as defined in Section 7-9-3(G).

Taxation and Revenue Department and submit proof of Internal Revenue

(7-9-49)

Service 501(c)(3) nonprofit determination before they may execute Type 9

5) By a person who is licensed to practice medicine, osteopathic medicine,

NTTCs. Those 501(c)(3) organizations that are organized for the purpose of

dentistry, podiatry, optometry, chiropractic or professional nursing for the

providing homeownership opportunities to low-income families may purchase

purchase of prosthetic devices. (7-9-73)

construction materials incorporated into these construction projects.

6) By a common carrier for the purchase of fuel that is to be loaded or used

3) Federal or state-chartered credit unions. (7-9-54 and 7-9-61.2)

in a locomotive engine. (7-9-110.1 & 7-9-110.3)

4) Indian tribes, nations or pueblos when purchasing tangible personal property

for use on Indian reservations or pueblo grants. (7-9-54)

Type 5 certificates may be executed:

1) For the purchase of services for resale if the subsequent sale by the buyer

Type 10 certificates may be executed by a person that holds an interest in

is in the ordinary course of business and the subsequent sale of the service

a qualified generating facility for the purchase or lease of tangible personal

is subject to gross receipts tax or governmental gross receipts tax. (7-9-48)

property or services that are eligible generation plant costs. In addition to

2) For the purchase of services for export when sold to an out-of-state buyer

required reporting on the CRS-1 Form, sellers who accept this certificate for

and delivery and initial use of the product of the service occurs outside

a qualified purchase must also report this deduction on form RPD-41349

New Mexico. (7-9-57)

Advanced Energy Deduction.

3) By manufacturers for the purchase of services performed directly upon

Type 11 certificates may be executed by manufactures for the purchase

tangible personal property they are in the business of manufacturing or upon

of tangible personal property that will be consumed in the manufacturing

ingredient or component parts thereof. (7-9-75)

process and may not be used to purchase tools or equipment that may be

4) For the purchase of aerospace services for resale if the subsequent sale

used to create the manufactured product. The Type 11 NTTC is not to be

by the buyer is in the ordinary course of business and the services are sold

used for the purchase of utilities. (7-9-46B)

3

to a 501(c)(3) organization, other than a national laboratory, or to the United

Type 12 certificates may be executed by manufactures for the purchase

States. (7-9-54.1)

of utilities that will be consumed in the manufacturing process. (7-9-46B)

3

Type 6 certificates may be executed by a construction contractor:

Type 15 certificates may be executed by qualified federal contractors on

1) For the purchase of construction materials that will become ingredients

a contract-by-contract basis. A copy of the federal contract is required. The

or components of a construction project that is either subject to gross

Taxation and Revenue Department may contact you for additional information.

receipts tax upon completion or that takes place on Indian tribal territory.

(7-9-51) Enter your contractor’s license number on the application or

Type 16 certificates may be executed by:

submit proof that such a number is not required.

2

1) Qualified film production companies to purchase property, lease property

2) For the purchase of construction services that are directly contracted for

or purchase services. A qualified production company must submit proof of

or billed to a construction project that is either subject to gross receipts tax

registration with the New Mexico Film Division of the Economic Development

upon completion, upon the sale in the ordinary course of business of the

Department. (7-9-86)

real property upon which the project is constructed or that takes place on

2) Accredited diplomats or missions for the purchase of property or services

Indian tribal territory. (7-9-52) Enter your contractor’s license number on

or the leasing of property. (7-9-89)

the application or submit proof that such a number is not required.

2

Type NTTC-OSB certificates may be executed by OUT-OF-STATE

3) For the purchase of construction-related services that are directly

BUYERS for the purchase of tangible personal property that will be resold

contracted for or billed to a construction project that is either subject to

or become an ingredient or component of a manufactured product, or for

gross receipts tax upon completion, upon the sale in the ordinary course

services performed on a manufactured product. Type NTTC-OSBs

of business of the real property upon which the project is constructed or

that takes place on Indian tribal territory. (7-9-52) Enter your contractor’s

must be obtained by the seller.

Type 2, 5 and 6 certificates are also optional forms of documentation for other gross receipts tax deductions. For more information on the use of different types of NTTCs

1

please see publication FYI-204: Nontaxable Transaction Certificates online at

204__NONTAXABLE%20TRANSACTION%20CERTIFICATES_NTTCs,%202008.pdf or request it from your local district tax office.

Proof that a construction contractor's license is not required includes a detailed written statement explaining the circumstances that exclude the contractor from the jurisdiction

2

or application of New Mexico statutes which provide for construction contractor's licensing and regulation of construction activity.

Application for Type 11 or 12 Nontaxable Transaction Certificates

Type 11 and 12 NTTCs require the completion of an alternative application, Form RPD-41378,

, avaliable

3

online at or from your local district office.

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2