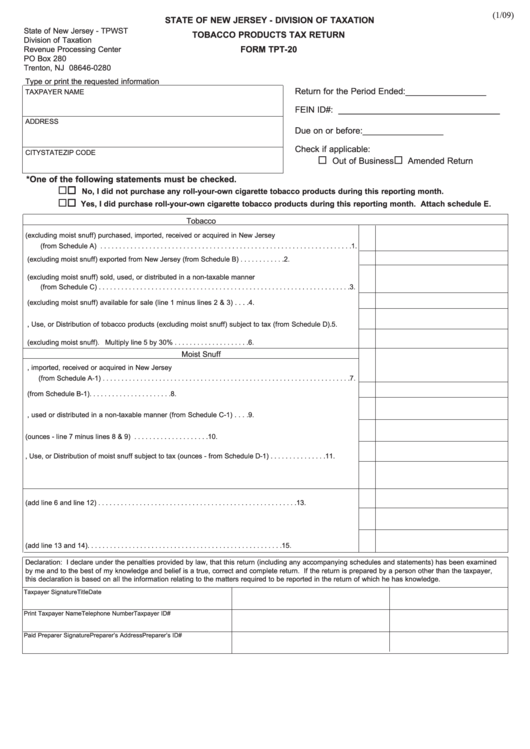

(1/09)

STATE OF NEW JERSEY - DIVISION OF TAXATION

State of New Jersey - TPWST

TOBACCO PRODUCTS TAX RETURN

Division of Taxation

Revenue Processing Center

FORM TPT-20

PO Box 280

Trenton, NJ 08646-0280

Type or print the requested information

Return for the Period Ended:

_________________

TAXPAYER NAME

FEIN ID#: __________________________________

ADDRESS

Due on or before:

_________________

Check if applicable:

CITY

STATE

ZIP CODE

Out of Business

Amended Return

*One of the following statements must be checked.

No, I did not purchase any roll-your-own cigarette tobacco products during this reporting month.

Yes, I did purchase roll-your-own cigarette tobacco products during this reporting month. Attach schedule E.

Tobacco

1.Tobacco products (excluding moist snuff) purchased, imported, received or acquired in New Jersey

(from Schedule A) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

1.

2. Tobacco products (excluding moist snuff) exported from New Jersey (from Schedule B) . . . . . . . . . . . .

2.

3. Tobacco products (excluding moist snuff) sold, used, or distributed in a non-taxable manner

(from Schedule C) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

3.

4. Purchases of tobacco products (excluding moist snuff) available for sale (line 1 minus lines 2 & 3) . . . .

4.

5. Sale, Use, or Distribution of tobacco products (excluding moist snuff) subject to tax (from Schedule D).

5.

6. Tax due on tobacco products (excluding moist snuff). Multiply line 5 by 30% . . . . . . . . . . . . . . . . . . . .

6.

Moist Snuff

7. Total ounces of moist snuff purchased, imported, received or acquired in New Jersey

(from Schedule A-1) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . .

7.

8. Total ounces of moist snuff exported out of New Jersey (from Schedule B-1). . . . . . . . . . . . . . . . . . . . . .

8.

9. Total ounces of moist snuff sold, used or distributed in a non-taxable manner (from Schedule C-1) . . . .

9.

10. Purchases of moist snuff available for sale (ounces - line 7 minus lines 8 & 9) . . . . . . . . . . . . . . . . . . . . 10.

11. Sale, Use, or Distribution of moist snuff subject to tax (ounces - from Schedule D-1) . . . . . . . . . . . . . . . 11.

12. Tax due on moist snuff. Multiply line 11 by 0.75 . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 12.

13. Total tax due (add line 6 and line 12) . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 13.

14. Penalty and Interest . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 14.

15. Total amount due (add line 13 and 14). . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . . 15.

Declaration: I declare under the penalties provided by law, that this return (including any accompanying schedules and statements) has been examined

by me and to the best of my knowledge and belief is a true, correct and complete return. If the return is prepared by a person other than the taxpayer,

this declaration is based on all the information relating to the matters required to be reported in the return of which he has knowledge.

Taxpayer Signature

Title

Date

Print Taxpayer Name

Telephone Number

Taxpayer ID#

Paid Preparer Signature

Preparer’s Address

Preparer’s ID#

1

1 2

2 3

3