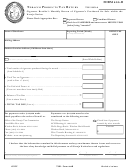

SPECIFIC INSTRUCTIONS FOR COMPLETING TPT-20 RETURN

Check Box

You must check the appropriate box concerning the purchase of roll-your-own cigarette tobacco products. If yes,

include information on Schedule E and attach Schedule E to the TPT-20.

LINE 1

Enter from Schedule A, the total wholesale price of all tobacco products, excluding moist snuff, purchased, imported,

received or acquired in New Jersey.

LINE 2

Enter from Schedule B, the total wholesale price of tobacco products, excluding moist snuff, exported from New

Jersey.

LINE 3

Enter from Schedule C, the total wholesale price of tobacco products, excluding moist snuff, sold, used or distributed in

a non-taxable manner.

LINE 4

Enter the total of Line 1 minus Lines 2 and 3 to determine the total of tobacco products, excluding moist snuff,

purchased and available for sale.

LINE 5

Enter from Schedule D, the total of tobacco products, excluding moist snuff, sold, used or distributed for this reporting

period that were subject to the Tobacco Products Tax.

LINE 6

Enter the total Tobacco Products Tax due, excluding moist snuff, by multiplying Line 5 by 30%.

LINE 7

Enter from Schedule A-1, the total number of ounces of moist snuff purchased, imported, received or acquired in New

Jersey. Report whole numbers.

LINE 8

Enter from Schedule B-1, the total number of ounces of moist snuff exported from New Jersey. Report whole

numbers.

LINE 9

Enter from Schedule C-1, the total number of ounces of moist snuff sold, used or distributed in a non-taxable manner.

Report whole numbers.

LINE 10

Enter the total of Line 7 minus Lines 8 and 9, to determine the number of ounces of moist tobacco purchased and

available for sale. Report whole numbers.

LINE 11

Enter from Schedule D-1, the total number of ounces of moist snuff sold, used or distributed subject to the tax. Report

whole numbers.

LINE 12

Enter the total Tobacco Products Tax due on moist snuff by multiplying Line 12 by $0.75.

LINE 13

Enter the total Tobacco Products Tax due by adding Line 6 and Line 12 together and entering the total on this line.

LINE 14

Enter the total penalty and interest due on returns and/or tax payments filed or paid late.

LINE 15

Enter the total due by adding Lines 13 and 14 together.

This return is to be signed and mailed to the address indicated on the return together with a check or money order for the

total Tobacco Products Tax Due.

1

1 2

2 3

3