Instructions For Form 1450 - Distributor'S Fuel Tax Report

ADVERTISEMENT

EIN00013

11-25-13

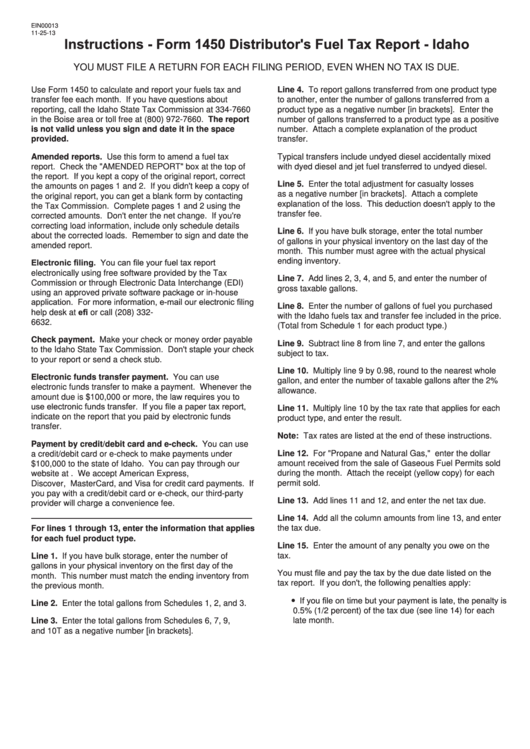

Instructions - Form 1450 Distributor's Fuel Tax Report - Idaho

YOU MUST FILE A RETURN FOR EACH FILING PERIOD, EVEN WHEN NO TAX IS DUE.

Use Form 1450 to calculate and report your fuels tax and

Line 4. To report gallons transferred from one product type

transfer fee each month. If you have questions about

to another, enter the number of gallons transferred from a

reporting, call the Idaho State Tax Commission at 334-7660

product type as a negative number [in brackets]. Enter the

in the Boise area or toll free at (800) 972-7660. The report

number of gallons transferred to a product type as a positive

is not valid unless you sign and date it in the space

number. Attach a complete explanation of the product

provided.

transfer.

Amended reports. Use this form to amend a fuel tax

Typical transfers include undyed diesel accidentally mixed

report. Check the "AMENDED REPORT" box at the top of

with dyed diesel and jet fuel transferred to undyed diesel.

the report. If you kept a copy of the original report, correct

Line 5. Enter the total adjustment for casualty losses

the amounts on pages 1 and 2. If you didn't keep a copy of

as a negative number [in brackets]. Attach a complete

the original report, you can get a blank form by contacting

explanation of the loss. This deduction doesn't apply to the

the Tax Commission. Complete pages 1 and 2 using the

transfer fee.

corrected amounts. Don't enter the net change. If you're

correcting load information, include only schedule details

Line 6. If you have bulk storage, enter the total number

about the corrected loads. Remember to sign and date the

of gallons in your physical inventory on the last day of the

amended report.

month. This number must agree with the actual physical

Electronic filing. You can file your fuel tax report

ending inventory.

electronically using free software provided by the Tax

Line 7. Add lines 2, 3, 4, and 5, and enter the number of

Commission or through Electronic Data Interchange (EDI)

gross taxable gallons.

using an approved private software package or in-house

application. For more information, e-mail our electronic filing

Line 8. Enter the number of gallons of fuel you purchased

help desk at efilehelp@tax.idaho.gov or call (208) 332-

with the Idaho fuels tax and transfer fee included in the price.

6632.

(Total from Schedule 1 for each product type.)

Check payment. Make your check or money order payable

Line 9. Subtract line 8 from line 7, and enter the gallons

to the Idaho State Tax Commission. Don't staple your check

subject to tax.

to your report or send a check stub.

Line 10. Multiply line 9 by 0.98, round to the nearest whole

Electronic funds transfer payment. You can use

gallon, and enter the number of taxable gallons after the 2%

electronic funds transfer to make a payment. Whenever the

allowance.

amount due is $100,000 or more, the law requires you to

use electronic funds transfer. If you file a paper tax report,

Line 11. Multiply line 10 by the tax rate that applies for each

indicate on the report that you paid by electronic funds

product type, and enter the result.

transfer.

Note: Tax rates are listed at the end of these instructions.

Payment by credit/debit card and e-check. You can use

Line 12. For "Propane and Natural Gas," enter the dollar

a credit/debit card or e-check to make payments under

amount received from the sale of Gaseous Fuel Permits sold

$100,000 to the state of Idaho. You can pay through our

website at tax.idaho.gov. We accept American Express,

during the month. Attach the receipt (yellow copy) for each

permit sold.

Discover, MasterCard, and Visa for credit card payments. If

you pay with a credit/debit card or e-check, our third-party

Line 13. Add lines 11 and 12, and enter the net tax due.

provider will charge a convenience fee.

Line 14. Add all the column amounts from line 13, and enter

the tax due.

For lines 1 through 13, enter the information that applies

for each fuel product type.

Line 15. Enter the amount of any penalty you owe on the

tax.

Line 1. If you have bulk storage, enter the number of

gallons in your physical inventory on the first day of the

You must file and pay the tax by the due date listed on the

month. This number must match the ending inventory from

tax report. If you don't, the following penalties apply:

the previous month.

y If you file on time but your payment is late, the penalty is

Line 2. Enter the total gallons from Schedules 1, 2, and 3.

0.5% (1/2 percent) of the tax due (see line 14) for each

late month.

Line 3. Enter the total gallons from Schedules 6, 7, 9,

and 10T as a negative number [in brackets].

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2