Publication 4436 - General Rules And Specifications For Substitute Form 941, Schedule B (Form 941), Schedule D (Form 941), Schedule R (Form 941), And Form 8974 Page 10

ADVERTISEMENT

used or they vary in form from the official form, processing may be delayed

and you may be subject to penalties.

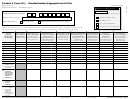

.02 Use Schedule R to allocate the aggregate information reported on Form

941 to each client. If you have more than 10 clients, complete as many

Continuation Sheets for Schedule R as necessary. Attach Schedule R,

including any Continuation Sheets, to your aggregate Form 941 and file it with

your return. Enter your business information carefully.

Make sure all information exactly matches the information shown on the

aggregate Form 941. Compare the total of each column on Schedule R, line 14

(including your information on line 13), to the amounts reported on the

aggregate Form 941. For each column total of Schedule R, the relevant line

from Form 941 is noted in the column heading. If the totals on Schedule R,

line 14, do not match the totals on Form 941, there is an error that must be

corrected before submitting Form 941 and Schedule R.

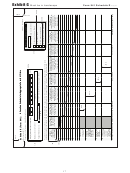

.03 Do:

Develop and submit only conforming Schedules R.

Follow the format and fields exactly as on the official Schedule R.

Maintain the same number of entry lines on the substitute Schedule R as

on the official form.

.04 Do not:

Add or delete entry lines.

Submit spreadsheets, database printouts, or similar formatted documents

instead of using the Schedule R format to report data.

Reduce or expand font size to add or delete extra data or lines.

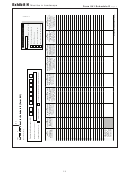

.05 If substitute Schedules R and Continuation Sheets for Schedule R are not

submitted in similar format to the official schedule, the substitutes may be

returned, you may be contacted by the IRS, delays in processing may occur,

and you may be subject to penalties.

Section 1.7 – Specific Instructions for Form 8974

.01 To properly file and to reduce delays and contact from the IRS, Form 8974

must be produced as close as possible to the official form.

.02 Use Form 8974 only if you are claiming the qualified small business

payroll tax credit for increasing research activities.

.03 If a substitute Form 8974 is not submitted in similar format to the official

IRS form, the substitutes may be returned, you may be contacted by the IRS,

delays in processing may occur, and you may be subject to penalties.

8

ADVERTISEMENT

0 votes

Related Articles

Related forms

Related Categories

Parent category: Financial

1

1 2

2 3

3 4

4 5

5 6

6 7

7 8

8 9

9 10

10 11

11 12

12 13

13 14

14 15

15 16

16 17

17 18

18 19

19 20

20 21

21